Reset This Form

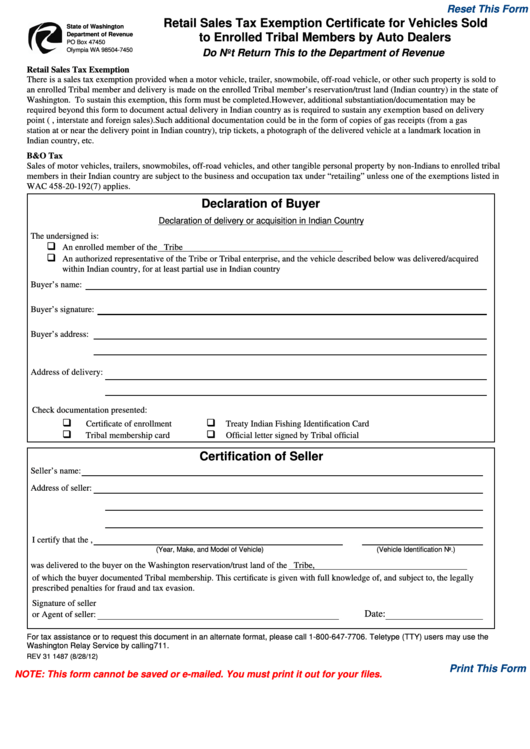

Retail Sales Tax Exemption Certificate for Vehicles Sold

State of Washington

Department of Revenue

to Enrolled Tribal Members by Auto Dealers

PO Box 47450

Olympia WA 98504-7450

Do Not Return This to the Department of Revenue

Retail Sales Tax Exemption

There is a sales tax exemption provided when a motor vehicle, trailer, snowmobile, off-road vehicle, or other such property is sold to

an enrolled Tribal member and delivery is made on the enrolled Tribal member’s reservation/trust land (Indian country) in the state of

Washington. To sustain this exemption, this form must be completed. However, additional substantiation/documentation may be

required beyond this form to document actual delivery in Indian country as is required to sustain any exemption based on delivery

point (e.g., interstate and foreign sales). Such additional documentation could be in the form of copies of gas receipts (from a gas

station at or near the delivery point in Indian country), trip tickets, a photograph of the delivered vehicle at a landmark location in

Indian country, etc.

B&O Tax

Sales of motor vehicles, trailers, snowmobiles, off-road vehicles, and other tangible personal property by non-Indians to enrolled tribal

members in their Indian country are subject to the business and occupation tax under “retailing” unless one of the exemptions listed in

WAC 458-20-192(7) applies.

Declaration of Buyer

Declaration of delivery or acquisition in Indian Country

The undersigned is:

An enrolled member of the

Tribe

An authorized representative of the Tribe or Tribal enterprise, and the vehicle described below was delivered/acquired

within Indian country, for at least partial use in Indian country

Buyer’s name:

Buyer’s signature:

Buyer’s address:

Address of delivery:

Check documentation presented:

Certificate of enrollment

Treaty Indian Fishing Identification Card

Tribal membership card

Official letter signed by Tribal official

Certification of Seller

Seller’s name:

Address of seller:

I certify that the ,

(Year, Make, and Model of Vehicle)

(Vehicle Identification No.)

was delivered to the buyer on the Washington reservation/trust land of the

Tribe,

of which the buyer documented Tribal membership. This certificate is given with full knowledge of, and subject to, the legally

prescribed penalties for fraud and tax evasion.

Signature of seller

Date:

or Agent of seller:

For tax assistance or to request this document in an alternate format, please call 1-800-647-7706. Teletype (TTY) users may use the

Washington Relay Service by calling 711.

REV 31 1487 (8/28/12)

Print This Form

NOTE: This form cannot be saved or e-mailed. You must print it out for your files.

1

1