Hourly Rate Billing Calculation

Download a blank fillable Hourly Rate Billing Calculation in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Hourly Rate Billing Calculation with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

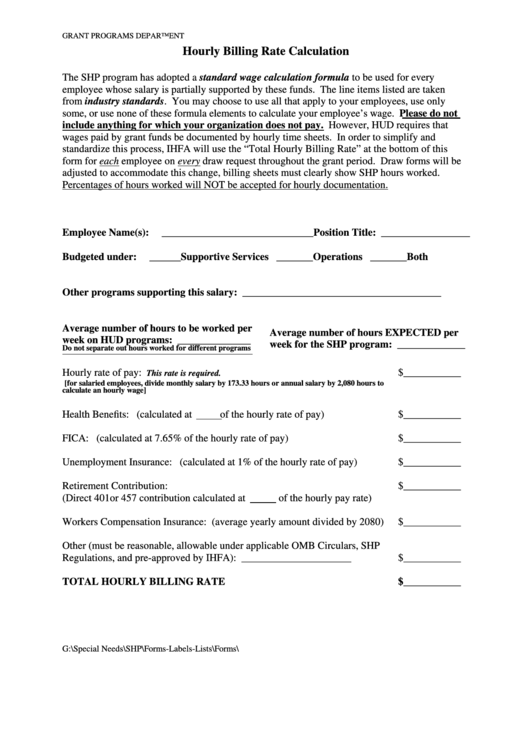

GRANT PROGRAMS DEPARTMENT

Hourly Billing Rate Calculation

The SHP program has adopted a standard wage calculation formula to be used for every

employee whose salary is partially supported by these funds. The line items listed are taken

from industry standards. You may choose to use all that apply to your employees, use only

some, or use none of these formula elements to calculate your employee’s wage. Please do not

include anything for which your organization does not pay. However, HUD requires that

wages paid by grant funds be documented by hourly time sheets. In order to simplify and

standardize this process, IHFA will use the “Total Hourly Billing Rate” at the bottom of this

form for each employee on every draw request throughout the grant period. Draw forms will be

adjusted to accommodate this change, billing sheets must clearly show SHP hours worked.

Percentages of hours worked will NOT be accepted for hourly documentation.

Employee Name(s):

_____________________________Position Title: _________________

Budgeted under:

______Supportive Services _______Operations _______Both

Other programs supporting this salary: ______________________________________

Average number of hours to be worked per

Average number of hours EXPECTED per

week on HUD programs: ______________

week for the SHP program: _____________

Do not separate out hours worked for different programs

Hourly rate of pay:

$___________

This rate is required.

[for salaried employees, divide monthly salary by 173.33 hours or annual salary by 2,080 hours to

calculate an hourly wage]

Health Benefits: (calculated at

of the hourly rate of pay)

$___________

FICA: (calculated at 7.65% of the hourly rate of pay)

$___________

Unemployment Insurance: (calculated at 1% of the hourly rate of pay)

$___________

Retirement Contribution:

$___________

(Direct 401or 457 contribution calculated at

of the hourly pay rate)

Workers Compensation Insurance: (average yearly amount divided by 2080)

$___________

Other (must be reasonable, allowable under applicable OMB Circulars, SHP

Regulations, and pre-approved by IHFA): _____________________

$___________

TOTAL HOURLY BILLING RATE

$___________

G:\Special Needs\SHP\Forms-Labels-Lists\Forms\HourlyRateCalc.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1