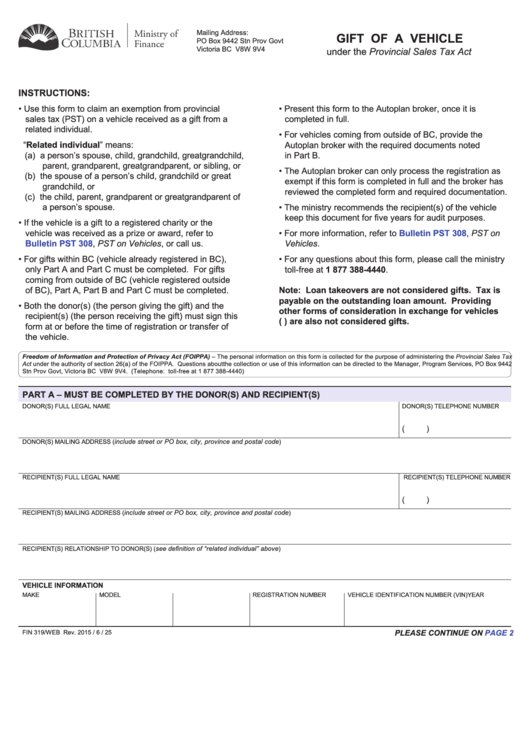

Form Fin 319 - Gift Of A Vehicle

Download a blank fillable Form Fin 319 - Gift Of A Vehicle in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Fin 319 - Gift Of A Vehicle with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Mailing Address:

GIFT OF A vehIcle

PO Box 9442 Stn Prov Govt

Victoria BC V8W 9V4

under the Provincial Sales Tax Act

gov.bc.ca/pst

INSTRUcTIONS:

• Use this form to claim an exemption from provincial

• Present this form to the Autoplan broker, once it is

sales tax (PST) on a vehicle received as a gift from a

completed in full.

related individual.

• For vehicles coming from outside of BC, provide the

“Related individual” means:

Autoplan broker with the required documents noted

(a) a person’s spouse, child, grandchild, greatgrandchild,

in Part B.

parent, grandparent, greatgrandparent, or sibling, or

• The Autoplan broker can only process the registration as

(b) the spouse of a person’s child, grandchild or great

exempt if this form is completed in full and the broker has

grandchild, or

reviewed the completed form and required documentation.

(c) the child, parent, grandparent or greatgrandparent of

a person’s spouse.

• The ministry recommends the recipient(s) of the vehicle

keep this document for five years for audit purposes.

• If the vehicle is a gift to a registered charity or the

vehicle was received as a prize or award, refer to

• For more information, refer to Bulletin PST

308, PST on

Bulletin PST

308, PST on Vehicles, or call us.

Vehicles.

• For gifts within BC (vehicle already registered in BC),

• For any questions about this form, please call the ministry

only Part A and Part C must be completed. For gifts

toll-free at 1 877 388-4440.

coming from outside of BC (vehicle registered outside

of BC), Part A, Part B and Part C must be completed.

Note: loan takeovers are not considered gifts. Tax is

payable on the outstanding loan amount. Providing

• Both the donor(s) (the person giving the gift) and the

other forms of consideration in exchange for vehicles

recipient(s) (the person receiving the gift) must sign this

(e.g. trades) are also not considered gifts.

form at or before the time of registration or transfer of

the vehicle.

Freedom of Information and Protection of Privacy Act (FOIPPA) – The personal information on this form is collected for the purpose of administering the Provincial Sales Tax

Act under the authority of section 26(a) of the FOIPPA. Questions about the collection or use of this information can be directed to the Manager, Program Services, PO Box 9442

Stn Prov Govt, Victoria BC V8W 9V4. (Telephone: toll-free at 1 877 388-4440)

PART A – MUST Be cOMPleTed By The dONOR(S) ANd RecIPIeNT(S)

DOnOr(S) FUll leGAl nAMe

DOnOr(S) TelePhOne nUMBer

( )

include street or PO box, city, province and postal code

DOnOr(S) MAIlInG ADDreSS (

)

reCIPIenT(S) FUll leGAl nAMe

reCIPIenT(S) TelePhOne nUMBer

( )

reCIPIenT(S) MAIlInG ADDreSS (

include street or PO box, city, province and postal code

)

reCIPIenT(S) relATIOnShIP TO DOnOr(S) (

see definition of “related individual” above

)

vehIcle INFORMATION

MAKe

MODel

YeAr

reGISTrATIOn nUMBer

VehICle IDenTIFICATIOn nUMBer (VIn)

PLEASE CONTINUE ON

PAGE 2

FIn 319/WeB rev. 2015 / 6 / 25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2