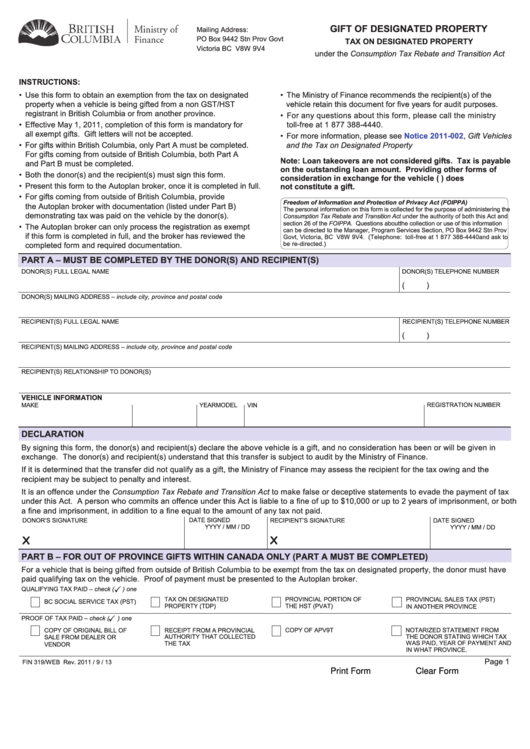

GIFT OF DESIGNATED PROPERTY

Mailing Address:

PO Box 9442 Stn Prov Govt

TAX ON DESIGNATED PROPERTY

Victoria BC V8W 9V4

under the Consumption Tax Rebate and Transition Act

INSTRUCTIONS:

• Use this form to obtain an exemption from the tax on designated

• The Ministry of Finance recommends the recipient(s) of the

property when a vehicle is being gifted from a non GST/HST

vehicle retain this document for five years for audit purposes.

registrant in British Columbia or from another province.

• For any questions about this form, please call the ministry

• Effective May 1, 2011, completion of this form is mandatory for

toll-free at 1 877 388-4440.

all exempt gifts. Gift letters will not be accepted.

•

For more information, please see Notice

2011-002, Gift Vehicles

• For gifts within British Columbia, only Part A must be completed.

and the Tax on Designated Property

For gifts coming from outside of British Columbia, both Part A

Note: loan takeovers are not considered gifts. Tax is payable

and Part B must be completed.

on the outstanding loan amount. Providing other forms of

• Both the donor(s) and the recipient(s) must sign this form.

consideration in exchange for the vehicle (e.g. trades) does

• Present this form to the Autoplan broker, once it is completed in full.

not constitute a gift.

• For gifts coming from outside of British Columbia, provide

Freedom of Information and Protection of Privacy Act (FOIPPA)

the Autoplan broker with documentation (listed under Part B)

The personal information on this form is collected for the purpose of administering the

demonstrating tax was paid on the vehicle by the donor(s).

Consumption Tax Rebate and Transition Act under the authority of both this Act and

section 26 of the FOIPPA. Questions about the collection or use of this information

• The Autoplan broker can only process the registration as exempt

can be directed to the Manager, Program Services Section, PO Box 9442 Stn Prov

if this form is completed in full, and the broker has reviewed the

Govt, Victoria, BC V8W 9V4. (Telephone: toll-free at 1 877 388-4440 and ask to

completed form and required documentation.

be re-directed.)

PART A – MUST bE COMPlETED bY ThE DONOR(S) AND RECIPIENT(S)

DOnOr(S) FUll lEGAl nAME

DOnOr(S) TElEPHOnE nUMBEr

( )

DOnOr(S) MAIlInG ADDrESS – include city, province and postal code

rECIPIEnT(S) FUll lEGAl nAME

rECIPIEnT(S) TElEPHOnE nUMBEr

( )

rECIPIEnT(S) MAIlInG ADDrESS – include city, province and postal code

rECIPIEnT(S) rElATIOnSHIP TO DOnOr(S)

vEhIClE INFORMATION

MAKE

MODEl

YEAr

VIn

rEGISTrATIOn nUMBEr

DEClARATION

By signing this form, the donor(s) and recipient(s) declare the above vehicle is a gift, and no consideration has been or will be given in

exchange. The donor(s) and recipient(s) understand that this transfer is subject to audit by the Ministry of Finance.

If it is determined that the transfer did not qualify as a gift, the Ministry of Finance may assess the recipient for the tax owing and the

recipient may be subject to penalty and interest.

It is an offence under the Consumption Tax Rebate and Transition Act to make false or deceptive statements to evade the payment of tax

under this Act. A person who commits an offence under this Act is liable to a fine of up to $10,000 or up to 2 years of imprisonment, or both

a fine and imprisonment, in addition to a fine equal to the amount of any tax not paid.

DOnOr’S SIGnATUrE

DATE SIGnED

rECIPIEnT’S SIGnATUrE

DATE SIGnED

YYYY / MM / DD

YYYY / MM / DD

X

X

PART b – FOR OUT OF PROvINCE GIFTS wIThIN CANADA ONlY (PART A MUST bE COMPlETED)

For a vehicle that is being gifted from outside of British Columbia to be exempt from the tax on designated property, the donor must have

paid qualifying tax on the vehicle. Proof of payment must be presented to the Autoplan broker.

QUAlIFYInG TAX PAID – check (

) one

TAX On DESIGnATED

PrOVInCIAl POrTIOn OF

PrOVInCIAl SAlES TAX (PST)

BC SOCIAl SErVICE TAX (PST)

PrOPErTY (TDP)

THE HST (PVAT)

In AnOTHEr PrOVInCE

PrOOF OF TAX PAID – check (

) one

nOTArIzED STATEMEnT FrOM

COPY OF OrIGInAl BIll OF

rECEIPT FrOM A PrOVInCIAl

COPY OF APV9T

AUTHOrITY THAT COllECTED

THE DOnOr STATInG WHICH TAX

SAlE FrOM DEAlEr Or

WAS PAID, YEAr OF PAYMEnT AnD

THE TAX

VEnDOr

In WHAT PrOVInCE.

Page 1

FIn 319/WEB rev. 2011 / 9 / 13

Print Form

Clear Form

1

1