Schedule J - Form 740 - Kentucky Farm Income Averaging

ADVERTISEMENT

J

SCHEDULE

*1600010016*

2016

Form 740

K

ENTUCKY

42A740-J (10-16)

F

I

A

ARM

NCOME

VERAGING

Department of Revenue

See federal instructions for Schedule J.

Attach to Form 740.

ä

ä

Enter name(s) as shown on tax return.

Your Social Security Number

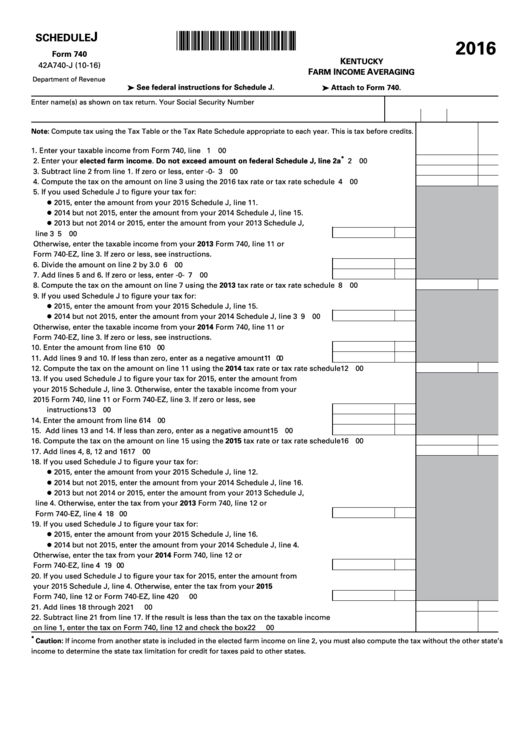

Note: Compute tax using the Tax Table or the Tax Rate Schedule appropriate to each year. This is tax before credits.

1. Enter your taxable income from Form 740, line 11.......................................................................................... 1

00

*

2. Enter your elected farm income. Do not exceed amount on federal Schedule J, line 2a

.......................... 2

00

3. Subtract line 2 from line 1. If zero or less, enter -0- ......................................................................................... 3

00

4. Compute the tax on the amount on line 3 using the 2016 tax rate or tax rate schedule ............................. 4

00

5. If you used Schedule J to figure your tax for:

2015, enter the amount from your 2015 Schedule J, line 11.

l

2014 but not 2015, enter the amount from your 2014 Schedule J, line 15.

l

2013 but not 2014 or 2015, enter the amount from your 2013 Schedule J,

l

line 3 ...................................................................................................................... 5

00

Otherwise, enter the taxable income from your 2013 Form 740, line 11 or

Form 740-EZ, line 3. If zero or less, see instructions.

6. Divide the amount on line 2 by 3.0 .......................................................................... 6

00

7. Add lines 5 and 6. If zero or less, enter -0- .............................................................. 7

00

8. Compute the tax on the amount on line 7 using the 2013 tax rate or tax rate schedule ............................. 8

00

9. If you used Schedule J to figure your tax for:

2015, enter the amount from your 2015 Schedule J, line 15.

l

2014 but not 2015, enter the amount from your 2014 Schedule J, line 3 ......... 9

00

l

Otherwise, enter the taxable income from your 2014 Form 740, line 11 or

Form 740-EZ, line 3. If zero or less, see instructions.

10. Enter the amount from line 6 ................................................................................... 10

00

11. Add lines 9 and 10. If less than zero, enter as a negative amount .........................11

00

12. Compute the tax on the amount on line 11 using the 2014 tax rate or tax rate schedule ............................ 12

00

13. If you used Schedule J to figure your tax for 2015, enter the amount from

your 2015 Schedule J, line 3. Otherwise, enter the taxable income from your

2015 Form 740, line 11 or Form 740-EZ, line 3. If zero or less, see

instructions ................................................................................................................ 13

00

14. Enter the amount from line 6 ................................................................................... 14

00

15. Add lines 13 and 14. If less than zero, enter as a negative amount ...................... 15

00

16. Compute the tax on the amount on line 15 using the 2015 tax rate or tax rate schedule ........................... 16

00

17. Add lines 4, 8, 12 and 16 .................................................................................................................................... 17

00

18. If you used Schedule J to figure your tax for:

2015, enter the amount from your 2015 Schedule J, line 12.

l

2014 but not 2015, enter the amount from your 2014 Schedule J, line 16.

l

2013 but not 2014 or 2015, enter the amount from your 2013 Schedule J,

l

line 4. Otherwise, enter the tax from your 2013 Form 740, line 12 or

Form 740-EZ, line 4 ............................................................................................. 18

00

19. If you used Schedule J to figure your tax for:

2015, enter the amount from your 2015 Schedule J, line 16.

l

2014 but not 2015, enter the amount from your 2014 Schedule J, line 4.

l

Otherwise, enter the tax from your 2014 Form 740, line 12 or

Form 740-EZ, line 4 .................................................................................................. 19

00

20. If you used Schedule J to figure your tax for 2015, enter the amount from

your 2015 Schedule J, line 4. Otherwise, enter the tax from your 2015

Form 740, line 12 or Form 740-EZ, line 4 ................................................................. 20

00

21. Add lines 18 through 20 .................................................................................................................................... 21

00

22. Subtract line 21 from line 17. If the result is less than the tax on the taxable income

on line 1, enter the tax on Form 740, line 12 and check the box .................................................................... 22

00

*

Caution: If income from another state is included in the elected farm income on line 2, you must also compute the tax without the other state’s

income to determine the state tax limitation for credit for taxes paid to other states.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2