Reset Form

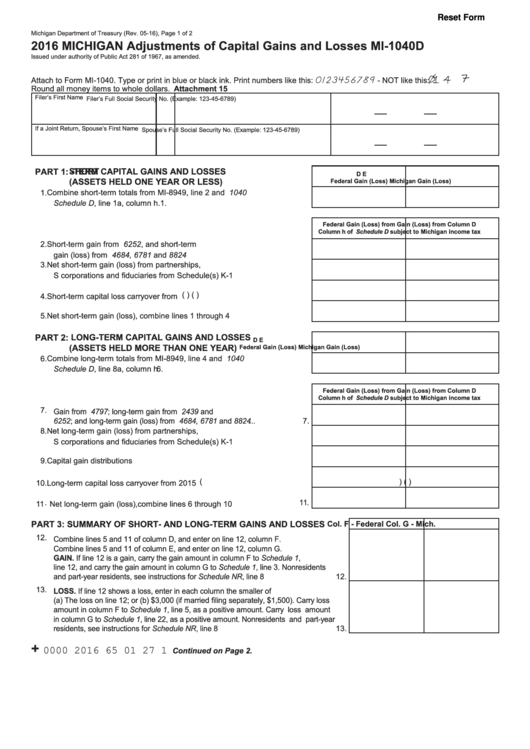

Michigan Department of Treasury (Rev. 05-16), Page 1 of 2

2016 MICHIGAN Adjustments of Capital Gains and Losses MI-1040D

Issued under authority of Public Act 281 of 1967, as amended.

1 4

0123456789

Attach to Form MI-1040. Type or print in blue or black ink. Print numbers like this:

- NOT like this:

Round all money items to whole dollars.

Attachment 15

Filer’s First Name

M.I.

Last Name

Filer’s Full Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

Spouse’s Full Social Security No. (Example: 123-45-6789)

SHORT

-TERM CAPITAL GAINS AND LOSSES

PART 1:

D

E

(ASSETS HELD ONE YEAR OR LESS)

Federal Gain (Loss)

Michigan Gain (Loss)

1. Combine short-term totals from MI-8949, line 2 and U.S. Form 1040

Schedule D, line 1a, column h..............................................................

1.

Federal Gain (Loss) from

Gain (Loss) from Column D

Column h of U.S. Schedule D

subject to Michigan income tax

2. Short-term gain from U.S. Form 6252, and short-term

gain (loss) from U.S. Forms 4684, 6781 and 8824...............................

2.

3. Net short-term gain (loss) from partnerships,

S corporations and fiduciaries from Schedule(s) K-1 ...........................

3.

4.

(

) (

)

4. Short-term capital loss carryover from 2015.........................................

5. Net short-term gain (loss), combine lines 1 through 4 ..........................

5.

PART 2: LONG-TERM CAPITAL GAINS AND LOSSES

D

E

(ASSETS HELD MORE THAN ONE YEAR)

Federal Gain (Loss)

Michigan Gain (Loss)

6. Combine long-term totals from MI-8949, line 4 and U.S. Form 1040

Schedule D, line 8a, column h ..............................................................

6.

Federal Gain (Loss) from

Gain (Loss) from Column D

Column h of U.S. Schedule D

subject to Michigan income tax

7. Gain from U.S. Form 4797; long-term gain from U.S. Forms 2439 and

6252; and long-term gain (loss) from U.S. Forms 4684, 6781 and 8824 ...

7.

8. Net long-term gain (loss) from partnerships,

S corporations and fiduciaries from Schedule(s) K-1 ...........................

8.

9. Capital gain distributions ......................................................................

9.

10. Long-term capital loss carryover from 2015 ......................................... 10.

(

) (

)

11 Net long-term gain (loss),combine lines 6 through 10 ..........................

.

11.

PART 3: SUMMARY OF SHORT- AND LONG-TERM GAINS AND LOSSES

Col. F - Federal

Col. G - Mich.

12. Combine lines 5 and 11 of column D, and enter on line 12, column F.

Combine lines 5 and 11 of column E, and enter on line 12, column G.

GAIN. If line 12 is a gain, carry the gain amount in column F to Schedule 1,

line 12, and carry the gain amount in column G to Schedule 1, line 3. Nonresidents

and part-year residents, see instructions for Schedule NR, line 8 ................................ 12.

13. LOSS. If line 12 shows a loss, enter in each column the smaller of

(a) The loss on line 12; or (b) $3,000 (if married filing separately, $1,500). Carry loss

amount in column F to Schedule 1, line 5, as a positive amount. Carry loss amount

in column G to Schedule 1, line 22, as a positive amount. Nonresidents and part-year

residents, see instructions for Schedule NR, line 8 ....................................................... 13.

+

0000 2016 65 01 27 1

Continued on Page 2.

1

1 2

2 3

3