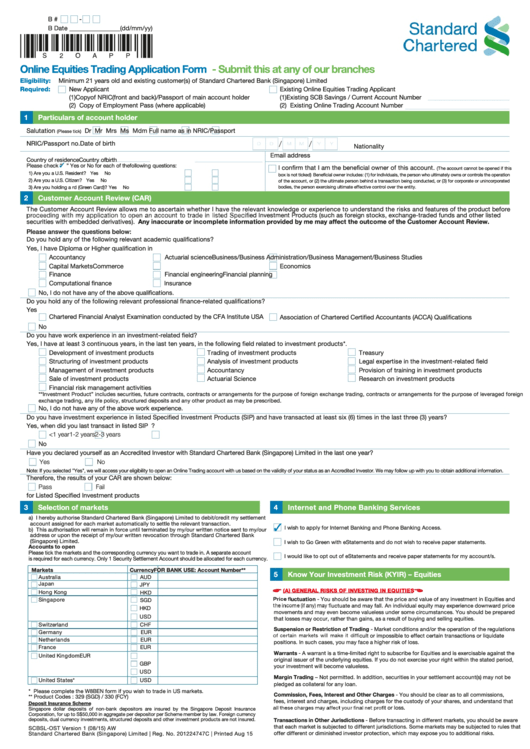

Online Equities Trading Application Form

ADVERTISEMENT

B #

-

B Date ________________(dd/mm/yy)

Online Equities Trading Application Form

- Submit this at any of our branches

Eligibility:

Minimum 21 years old and existing customer(s) of Standard Chartered Bank (Singapore) Limited

Required:

New Applicant

Existing Online Equities Trading Applicant

(1) Copy of NRIC (front and back)/Passport of main account holder

(1) Existing SCB Savings / Current Account Number

(2) Copy of Employment Pass (where applicable)

(2) Existing Online Trading Account Number

1

Particulars of account holder

Salutation

Dr

Mr

Mrs

Ms

Mdm

Full name as in NRIC/Passport

(Please tick)

NRIC/Passport no.

Date of birth

Nationality

Email address

Country of residence

Country of birth

Please check “ ” Yes or No for each of the following questions:

I con rm that I am the bene cial owner of this account.

(The account cannot be opened if this

1) Are you a U.S. Resident?

Yes

No

box is not ticked) Bene cial owner includes: (1) for individuals, the person who ultimately owns or controls the operation

2) Are you a U.S. Citizen?

Yes

No

of the account, or (2) the ultimate person behind a transaction being conducted, or (3) for corporate or unincorporated

3) Are you holding a U.S. Permanent Resident Card (Green Card)?

Yes

No

bodies, the person exercising ultimate effective control over the entity.

2

Customer Account Review (CAR)

The Customer Account Review allows me to ascertain whether I have the relevant knowledge or experience to understand the risks and features of the product before

ed Investment Products (such as foreign stocks, exchange-traded funds and other listed

securities with embedded derivatives).

Any inaccurate or incomplete information provided by me may affect the outcome of the Customer Account Review.

Please answer the questions below:

Do you hold any of the following relevant academic quali cations?

Yes, I have Diploma or Higher quali cation in

Accountancy

Actuarial science

Business/Business Administration/Business Management/Business Studies

Capital Markets

Commerce

Economics

Finance

Financial engineering

Financial planning

Computational nance

Insurance

No, I do not have any of the above quali cations.

Do you hold any of the following relevant professional nance-related quali cations?

Yes

Chartered Financial Analyst Examination conducted by the CFA Institute USA

Association of Chartered Certi ed Accountants (ACCA) Quali cations

No

Do you have work experience in an investment-related eld?

Yes, I have at least 3 continuous years, in the last ten years, in the following eld related to investment products*.

Development of investment products

Trading of investment products

Treasury

Structuring of investment products

Analysis of investment products

Legal expertise in the investment-related eld

Management of investment products

Accountancy

Provision of training in investment products

Sale of investment products

Actuarial Science

Research on investment products

Financial risk management activities

*“Investment Product” includes securities, future contracts, contracts or arrangements for the purpose of foreign exchange trading, contracts or arrangements for the purpose of leveraged foreign

exchange trading, any life policy, structured deposits and any other product as may be prescribed.

No, I do not have any of the above work experience.

Do you have investment experience in listed Speci ed Investment Products (SIP) and have transacted at least six (6) times in the last three (3) years?

Yes, when did you last transact in listed SIP e.g. listed equities?

2-3 years

<1 year

1-2 years

No

Have you declared yourself as an Accredited Investor with Standard Chartered Bank (Singapore) Limited in the last one year?

Yes

No

Note: If you selected "Yes", we will access your eligibility to open an Online Trading account with us based on the validity of your status as an Accredited Investor. We may follow up with you to obtain additional information.

Therefore, the results of your CAR are shown below:

Pass

Fail

for Listed Speci ed Investment products e.g. exchange traded funds or listed securities traded on an exchange outside Singapore

3

Selection of markets

4

Internet and Phone Banking Services

a) I hereby authorise Standard Chartered Bank (Singapore) Limited to debit/credit my settlement

account assigned for each market automatically to settle the relevant transaction.

✓

I wish to apply for Internet Banking and Phone Banking Access.

b) This authorisation will remain in force until terminated by my/our written notice sent to my/our

address or upon the receipt of my/our written revocation through Standard Chartered Bank

(Singapore) Limited.

I wish to Go Green with eStatements and do not wish to receive paper statements.

Accounts to open

Please tick the markets and the corresponding currency you want to trade in. A separate account

I would like to opt out of eStatements and receive paper statements for my account/s.

is required for each currency. Only 1 Security Settlement Account should be allocated for each currency.

Markets

Currency

FOR BANK USE: Account Number**

5

Know Your Investment Risk (KYIR) – Equities

Australia

AUD

Japan

JPY

(A) GENERAL RISKS OF INVESTING IN EQUITIES

Hong Kong

HKD

uctuation - You should be aware that the price and value of any investment in Equities and

Singapore

SGD

uctuate and may fall. An individual equity may experience downward price

HKD

movements and may even become valueless under some circumstances. You should be prepared

USD

that losses may occur, rather than gains, as a result of buying and selling equities.

Switzerland

CHF

Suspension or Restriction of Trading - Market conditions and/or the operation of the regulations

Germany

EUR

cult or impossible to effect certain transactions or liquidate

Netherlands

EUR

positions. In such cases, you may face a higher risk of loss.

France

EUR

Warrants - A warrant is a time-limited right to subscribe for Equities and is exercisable against the

United Kingdom

EUR

original issuer of the underlying equities. If you do not exercise your right within the stated period,

GBP

your investment will become valueless.

USD

Margin Trading – Not permitted. In addition, securities in your settlement account(s) may not be

United States*

USD

pledged as collateral for any loan.

* Please complete the W8BEN form if you wish to trade in US markets.

Commission, Fees, Interest and Other Charges - You should be clear as to all commissions,

** Product Codes : 329 (SGD) / 330 (FCY)

fees, interest and charges, including charges for the custody of your shares, and understand that

Deposit Insurance Scheme

t or loss.

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance

Corporation, for up to S$50,000 in aggregate per depositor per Scheme member by law. Foreign currency

deposits, dual currency investments, structured deposits and other investment products are not insured.

Transactions in Other Jurisdictions - Before transacting in different markets, you should be aware

that each market is subjected to different jurisdictions. Some markets may be subjected to rules that

SCBSL-OST Version 1 (08/15) AW

Standard Chartered Bank (Singapore) Limited | Reg. No. 201224747C | Printed Aug 15

offer different or diminished investor protection, which may expose you to additional risks.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2