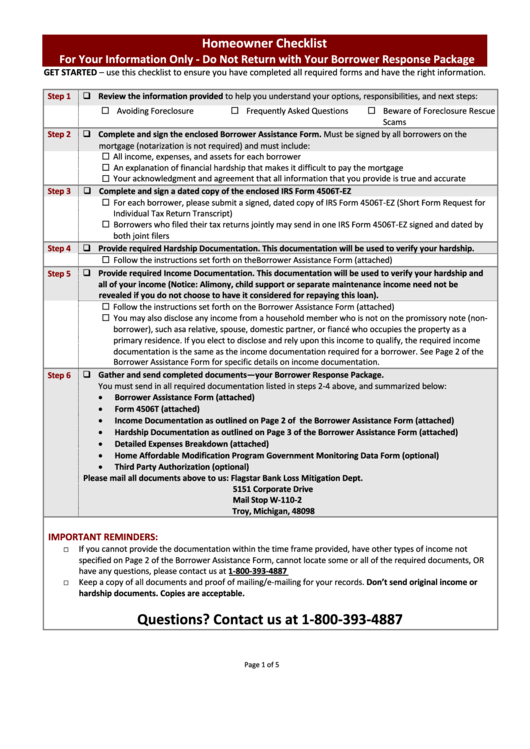

Homeowner Checklist

For Your Information Only - Do Not Return with Your Borrower Response Package

GET STARTED – use this checklist to ensure you have completed all required forms and have the right information.

Step 1

Review the information provided to help you understand your options, responsibilities, and next steps:

Avoiding Foreclosure

Frequently Asked Questions

Beware of Foreclosure Rescue

Scams

Step 2

Complete and sign the enclosed Borrower Assistance Form. Must be signed by all borrowers on the

mortgage (notarization is not required) and must include:

All income, expenses, and assets for each borrower

An explanation of financial hardship that makes it difficult to pay the mortgage

Your acknowledgment and agreement that all information that you provide is true and accurate

Step 3

Complete and sign a dated copy of the enclosed IRS Form 4506T-EZ

For each borrower, please submit a signed, dated copy of IRS Form 4506T-EZ (Short Form Request for

Individual Tax Return Transcript)

Borrowers who filed their tax returns jointly may send in one IRS Form 4506T-EZ signed and dated by

both joint filers

Step 4

Provide required Hardship Documentation. This documentation will be used to verify your hardship.

Follow the instructions set forth on the Borrower Assistance Form (attached)

Step 5

Provide required Income Documentation. This documentation will be used to verify your hardship and

all of your income (Notice: Alimony, child support or separate maintenance income need not be

revealed if you do not choose to have it considered for repaying this loan).

Follow the instructions set forth on the Borrower Assistance Form (attached)

You may also disclose any income from a household member who is not on the promissory note (non-

borrower), such as a relative, spouse, domestic partner, or fiancé who occupies the property as a

primary residence. If you elect to disclose and rely upon this income to qualify, the required income

documentation is the same as the income documentation required for a borrower. See Page 2 of the

Borrower Assistance Form for specific details on income documentation.

Step 6

Gather and send completed documents—your Borrower Response Package.

You must send in all required documentation listed in steps 2-4 above, and summarized below:

•

Borrower Assistance Form (attached)

•

Form 4506T (attached)

•

Income Documentation as outlined on Page 2 of the Borrower Assistance Form (attached)

•

Hardship Documentation as outlined on Page 3 of the Borrower Assistance Form (attached)

•

Detailed Expenses Breakdown (attached)

•

Home Affordable Modification Program Government Monitoring Data Form (optional)

•

Third Party Authorization (optional)

Please mail all documents above to us: Flagstar Bank Loss Mitigation Dept.

5151 Corporate Drive

Mail Stop W-110-2

Troy, Michigan, 48098

IMPORTANT REMINDERS:

□

If you cannot provide the documentation within the time frame provided, have other types of income not

specified on Page 2 of the Borrower Assistance Form, cannot locate some or all of the required documents, OR

have any questions, please contact us at 1-800-393-4887

□

Keep a copy of all documents and proof of mailing/e-mailing for your records. Don’t send original income or

hardship documents. Copies are acceptable.

Questions? Contact us at 1-800-393-4887

Page 1 of 5

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17