Residential Guidelines

ADVERTISEMENT

Residential Guidelines

First National specializes in making real estate loans that other lenders won't. We are able to make these loans because

we are a portfolio lender so we're not subject to the limitations of the secondary market. Also, we have outstanding and

experienced collection and customer service departments.

Examples of loans that we do that others won't: Previous bankruptcy, previous foreclosure, previous short

sale, prior modification, HOEPA/Section 32 loans, mobile homes of any age, no maximum acreage,

vacant land, and zoning problems.

We are willing to take some risk and to give your customer a second chance. But these loans are riskier than the

conventional loan so we underwrite them carefully. What does that mean to you? We don't offer prequals or

preapprovals because we need to see a full application, income verification, and credit report in order to price the loan

accordingly. But our conditional approval requirements are very reasonable - see Submission Form.

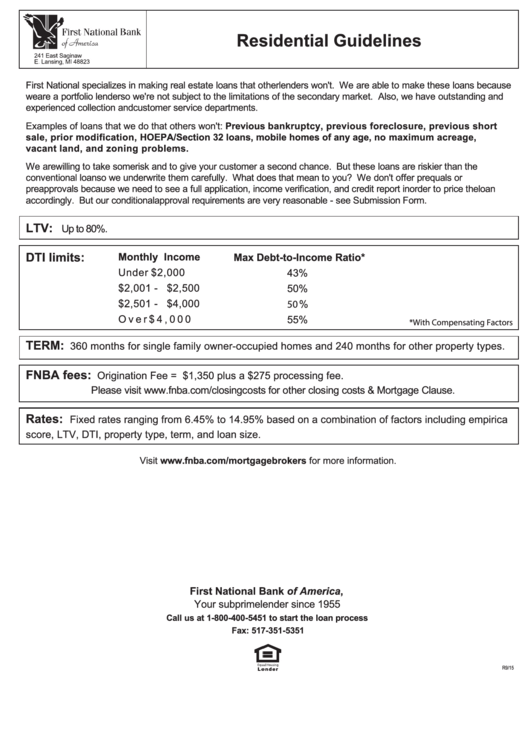

LTV:

Up to 80%.

DTI limits:

Monthly Income

Max Debt-to-Income Ratio*

Under

$2,000

43%

$2,001 - $2,500

50%

$2,501 - $4,000

50 %

O v e r

$ 4 , 0 0 0

55%

*With Compensating Factors

TERM:

360 months for single family owner-occupied homes and 240 months for other property types.

FNBA fees:

Origination Fee = $1,350 plus a $275 processing fee.

Please visit for other closing costs & Mortgage Clause.

Rates:

Fixed rates ranging from 6.45% to 14.95% based on a combination of factors including empirica

score, LTV, DTI, property type, term, and loan size.

Visit for more information.

First National Bank of America,

Your subprime lender since 1955

Call us at 1-800-400-5451 to start the loan process

Fax: 517-351-5351

R9/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2