Rehabilitation Of Historic Properties Tax Credit Worksheet 2007

ADVERTISEMENT

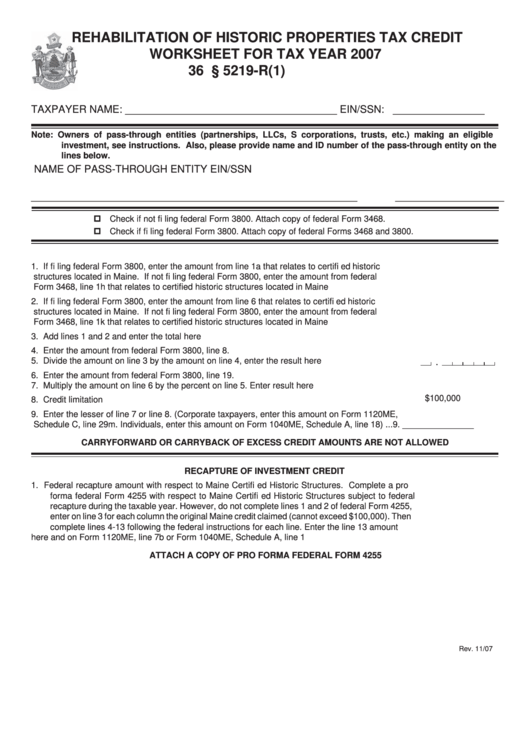

REHABILITATION OF HISTORIC PROPERTIES TAX CREDIT

WORKSHEET FOR TAX YEAR 2007

36 M.R.S.A. § 5219-R(1)

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of the pass-through entity on the

lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

_________________________________________________________

___________________

Check if not fi ling federal Form 3800. Attach copy of federal Form 3468.

Check if fi ling federal Form 3800. Attach copy of federal Forms 3468 and 3800.

1.

If fi ling federal Form 3800, enter the amount from line 1a that relates to certifi ed historic

structures located in Maine. If not fi ling federal Form 3800, enter the amount from federal

Form 3468, line 1h that relates to certifi ed historic structures located in Maine .......................... 1. _______________

2.

If fi ling federal Form 3800, enter the amount from line 6 that relates to certifi ed historic

structures located in Maine. If not fi ling federal Form 3800, enter the amount from federal

Form 3468, line 1k that relates to certifi ed historic structures located in Maine .......................... 2. _______________

3.

Add lines 1 and 2 and enter the total here ................................................................................... 3. _______________

4.

Enter the amount from federal Form 3800, line 8. ....................................................................... 4. _______________

5.

Divide the amount on line 3 by the amount on line 4, enter the result here ................................ 5.

.

6.

Enter the amount from federal Form 3800, line 19. ..................................................................... 6. _______________

7.

Multiply the amount on line 6 by the percent on line 5. Enter result here .................................... 7. _______________

$100,000

8.

Credit limitation ............................................................................................................................ 8. _______________

9.

Enter the lesser of line 7 or line 8. (Corporate taxpayers, enter this amount on Form 1120ME,

Schedule C, line 29m. Individuals, enter this amount on Form 1040ME, Schedule A, line 18) ... 9. _______________

CARRYFORWARD OR CARRYBACK OF EXCESS CREDIT AMOUNTS ARE NOT ALLOWED

RECAPTURE OF INVESTMENT CREDIT

1.

Federal recapture amount with respect to Maine Certifi ed Historic Structures. Complete a pro

forma federal Form 4255 with respect to Maine Certifi ed Historic Structures subject to federal

recapture during the taxable year. However, do not complete lines 1 and 2 of federal Form 4255,

enter on line 3 for each column the original Maine credit claimed (cannot exceed $100,000). Then

complete lines 4-13 following the federal instructions for each line. Enter the line 13 amount

here and on Form 1120ME, line 7b or Form 1040ME, Schedule A, line 1 .................................. 1. _______________

ATTACH A COPY OF PRO FORMA FEDERAL FORM 4255

Rev. 11/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2