Form Ct-Ifta-2 - Application For International Fuel Tax Agreement (Ifta) License Connecticut Carrier - 2016 Page 2

ADVERTISEMENT

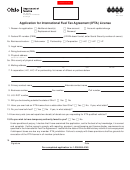

CT-IFTA-2 - Instructions

Do not use this CT-IFTA-2, Application For International Fuel Tax Agreement (IFTA) License Connecticut Carrier, to request

Connecticut motor carrier road tax decals. For Connecticut motor carrier road tax decals, submit Form REG-3-MC,

Application for Motor Carrier Road Tax.

Qualifi ed motor vehicles are those used, designed, or

Line 9: Check the appropriate box to indicate whether you

maintained for transportation of persons or property and:

are currently or were previously registered with another

jurisdiction for IFTA. If you check Yes, enter the name of the

•

Have two axles and a gross vehicle weight or registered

jurisdiction you are currently or were previously registered

gross vehicle weight exceeding 26,000 pounds or 11,797

in for IFTA.

kilograms;

Line 10: Provide details of your business operations or

•

Have three or more axles regardless of weight; or

activities.

•

Are used in combination and the combined gross vehicle

weight or registered gross vehicle weight exceeds 26,000

Line 11: Check the appropriate box to indicate if you store

pounds or 11,797 kilograms.

fuel in bulk. If you check Yes, list the city and state where

the fuel is stored.

The term qualifi ed motor vehicle does not include recreational

vehicles.

Line 11a: Enter an X next to the type(s) of fuel used in your

qualifi ed motor vehicles.

You may not transfer International Fuel Tax Agreement

(IFTA) decals to another person or from one vehicle to

Line 12: Provide a contact name and email address.

another.

This must be completed to permit online access for the

electronic filing of returns, renewal of the license, and

Line Instructions

ordering of additional decals.

Line 1: Check the appropriate box for a new account,

Line 13: Enter an X next to each jurisdiction in which you

registration of additional vehicles, or other reasons such

are likely to operate.

as, renewal, replacement decals, or change of ownership.

If there has been a change of identity, form of ownership, or

Line 14: Indicate the number of IFTA qualifi ed motor vehicles

organization, you must apply for a new CT-IFTA number.

requiring decals. Two numbered decals will be issued for

If you are registered with the Connecticut Department

each qualifi ed motor vehicle. One decal must be placed on

of Revenue Services (DRS), enter your Connecticut Tax

the lower rear exterior of the passenger side cab door and

Registration Number in the upper right corner of this form.

the matching decal must be placed on the lower rear exterior

of the driver side cab door of each vehicle.

Line 2: Print the name of the owner, partnership, corporation,

or limited liability company (LLC) and enter its Federal

This application must be signed by an owner, partner,

Employer Identifi cation Number (FEIN). Enter proprietor’s

corporate offi cer, or LLC member.

name if a sole proprietorship. If it is a sole proprietorship with

Failure to complete all items on this application may result in

no employees and is not required to have a FEIN, enter the

a delay in processing your application.

proprietor’s Social Security Number (SSN).

Make your check payable to Commissioner of Revenue

Line 3: Print the trade or registered name if different from

Services. DRS may submit your check to your bank

Line 2. A trade or registered name is the name under

electronically.

which business is done, but not necessarily the owner’s

name. Example: If John Travel is the proprietorship entered

Return the completed application with full payment to:

on Line 2, but John T. Trucker Co. is the name chosen by

Department of Revenue Services

John Travel for his business, then John T. Trucker Co. is the

Operations Bureau/Walk-in

name he would enter on Line 3.

PO Box 2937

Line 4: Print the physical location of the business. Do not

Hartford CT 06104-2937

use PO Boxes or rural route numbers. Indicate where the

If you need assistance or additional information about

business is actually located.

applications or registering your vehicle(s), call DRS at

Line 5: Print the mailing address of the business if different

860-297-4870, Monday through Friday, 8:30 a.m. to 4:30 p.m.

from Line 4. Complete only if mailing and business addresses

For More Information

are different.

Call DRS during business hours, Monday through Friday:

Line 6: Print the name and home address of the proprietor,

•

1-800-382-9463 (Connecticut calls outside the Greater

partner, corporate officer, or LLC member. Identify the

Hartford calling area only); or

proprietor if a sole proprietorship, partners if a partnership,

•

860-297-5962 (from anywhere).

or offi cers if a corporation.

TTY, TDD, and Text Telephone users only may transmit

Line 7: Print the names and home addresses of other

inquiries anytime by calling 860-297-4911.

partners, corporate offi cers, or LLC members.

Forms and Publications: Visit the DRS website at

Line 8: Check the appropriate box to indicate the type of

to download and print Connecticut tax

business. If Other, attach an explanation.

forms and publications.

Line 8a: Enter the name of the state under the laws of which

the business is organized.

CT-IFTA-2 Back (Rev. 12/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2