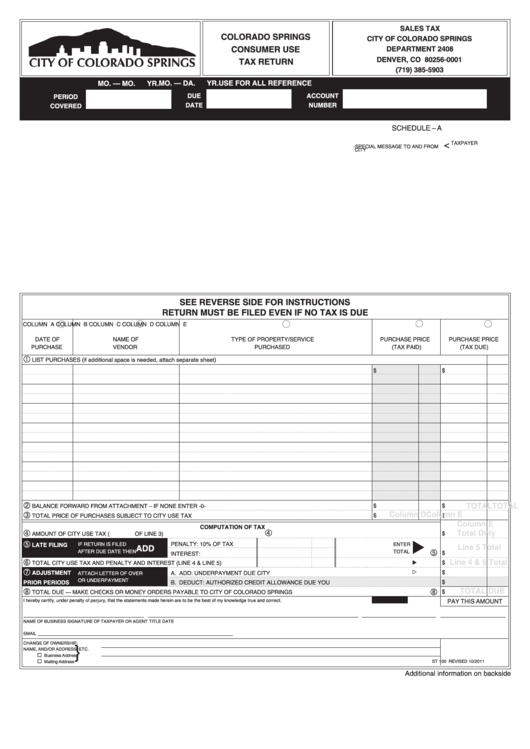

Colorado Springs Consumer Use Tax Return

ADVERTISEMENT

SALES TAX

COLORADO SPRINGS

CITY OF COLORADO SPRINGS

CONSUMER USE

DEPARTMENT 2408

DENVER, CO 80256-0001

TAX RETURN

(719) 385-5903

MO. — MO.

YR.

MO. — DA.

YR.

USE FOR ALL REFERENCE

DUE

ACCOUNT

PERIOD

DATE

NUMBER

COVERED

SCHEDULE – A

<

TAXPAYER

-SPECIAL MESSAGE TO AND FROM

CITY

SEE REVERSE SIDE FOR INSTRUCTIONS

RETURN MUST BE FILED EVEN IF NO TAX IS DUE

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN E

DATE OF

NAME OF

TYPE OF PROPERTY/SERVICE

PURCHASE PRICE

PURCHASE PRICE

PURCHASE

VENDOR

PURCHASED

(TAX PAID)

(TAX DUE)

À

LIST PURCHASES (if additional space is needed, attach separate sheet)

$

$

$

TOTAL

$

TOTAL

BALANCE FORWARD FROM ATTACHMENT – IF NONE ENTER -0-

Column D

Column E

TOTAL PRICE OF PURCHASES SUBJECT TO CITY USE TAX

$

$

Column E

COMPUTATION OF TAX

Total Only

AMOUNT OF CITY USE TAX (

OF LINE 3)

$

u

PENALTY: 10% OF TAX

LATE FILING

IF RETURN IS FILED

ENTER

ADD

Line 5 Total

AFTER DUE DATE THEN

TOTAL

$

INTEREST:

Line 4 & 5 Total

$

TOTAL CITY USE TAX AND PENALTY AND INTEREST (LINE 4 & LINE 5)

u

$

ADJUSTMENT

A. ADD: UNDERPAYMENT DUE CITY

w

ATTACH LETTER OF OVER

OR UNDERPAYMENT

PRIOR PERIODS

$

B. DEDUCT: AUTHORIZED CREDIT ALLOWANCE DUE YOU

TOTAL DUE

TOTAL DUE — MAKE CHECKS OR MONEY ORDERS PAYABLE TO CITY OF COLORADO SPRINGS

$

I hereby certify, under penalty of perjury, that the statements made herein are to be the best of my knowledge true and correct.

SIGN BELOW

PAY THIS AMOUNT

NAME OF BUSINESS

SIGNATURE OF TAXPAYER OR AGENT

TITLE

DATE

EMAIL

}

CHANGE OF OWNERSHIP,

NAME, AND/OR ADDRESS, ETC.

… Business Address

ST 100 REVISED 10/2011

… Mailing Address

Additional information on backside

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2