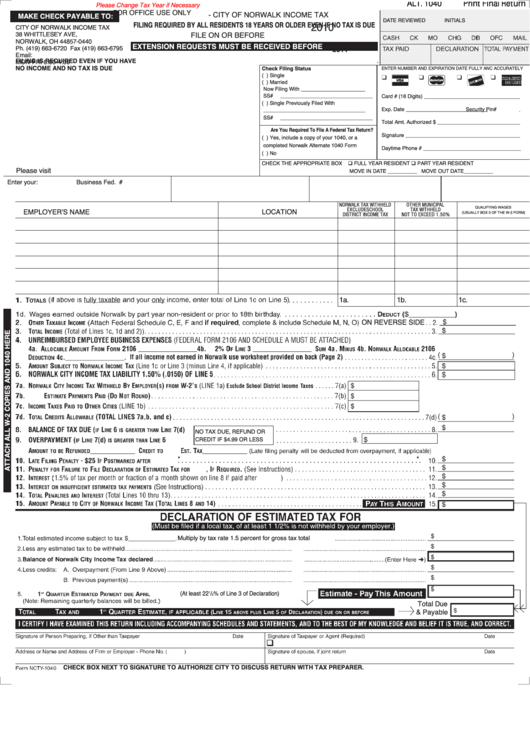

ALT. 1040

Print Final Return

Please Change Tax Year if Necessary

FOR OFFICE USE ONLY

- CITY OF NORWALK INCOME TAX

MAKE CHECK PAYABLE TO:

DATE REVIEWED

INITIALS

FILING REQUIRED BY ALL RESIDENTS 18 YEARS OR OLDER EVEN IF NO TAX IS DUE

2010

CITY OF NORWALK INCOME TAX

38 WHITTLESEY AVE, P.O. BOX 440

FILE ON OR BEFORE

NORWALK, OH 44857-0440

EXTENSION REQUESTS MUST BE RECEIVED BEFORE

Ph. (419) 663-6720 Fax (419) 663-6795

2011

Email:

FILING IS REQUIRED EVEN IF YOU HAVE

MON-FRI 8:00-4:30

NO INCOME AND NO TAX IS DUE

Check Filing Status

ENTER NUMBER AND EXPIRATION DATE FULLY ANC ACCURATELY

( ) Single

( ) Married

Now Filing With ______________________

SS#_______________________________

Card # (16 Digits) __________________________________

( ) Single Previously Filed With

Exp. Date ____________________

Security Pin#

____________

___________________________________

SS#_______________________________

Total Amt. Authorized $ _____________________________

Are You Required To File A Federal Tax Return?

Signature ________________________________________

( ) Yes, include a copy of your 1040, or a

completed Norwalk Alternate 1040 Form

Daytime Phone # __________________________________

( ) No

CHECK THE APPROPRIATE BOX

FULL YEAR RESIDENT PART YEAR RESIDENT

Please visit for the On-Line Tax Preparation Tool.

MOVE IN DATE __________ MOVE OUT DATE__________

Enter your:

Business Fed. I.D. No.

Social Security No.

Spouse Security No.

Phone #

NORWALK TAX WITHHELD

OTHER MUNICIPAL

QUALIFYING WAGES

EXCLUDE SCHOOL

TAX WITHHELD

EMPLOYER’S NAME

LOCATION

(USUALLY BOX 5 OF THE W-2 FORM)

NOT TO EXCEED 1.50%

DISTRICT INCOME TAX

1a.

1b.

1c.

ON REVERSE SIDE

NO TAX DUE, REFUND OR

CREDIT IF $4.99 OR LESS

*

*

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Multiply by tax rate 1.5 percent for gross tax total................

...........

...........

...........

...........

(At least 22

/

% of Line 3 of Declaration)

1

2

Total Due

& Payable

CHECK BOX NEXT TO SIGNATURE TO AUTHORIZE CITY TO DISCUSS RETURN WITH TAX PREPARER.

1

1 2

2 3

3