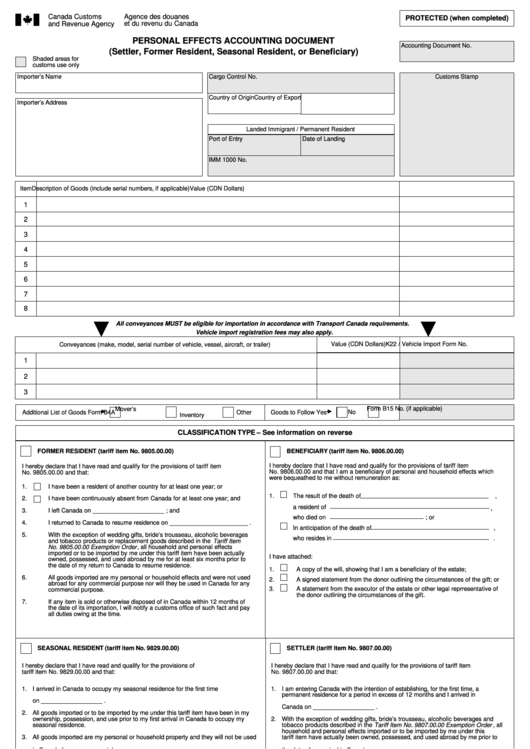

Personal Effects Accounting Document (Settler, Former Resident, Seasonal Resident, Or Beneficiary)

ADVERTISEMENT

Agence des douanes

Canada Customs

PROTECTED (when completed)

and Revenue Agency

et du revenu du Canada

PERSONAL EFFECTS ACCOUNTING DOCUMENT

Accounting Document No.

(Settler, Former Resident, Seasonal Resident, or Beneficiary)

Shaded areas for

customs use only

Importer’s Name

Cargo Control No.

Customs Stamp

Country of Origin

Country of Export

Importer’s Address

Landed Immigrant / Permanent Resident

Port of Entry

Date of Landing

IMM 1000 No.

Item

Description of Goods (include serial numbers, if applicable)

Value (CDN Dollars)

1

2

3

4

5

6

7

8

All conveyances MUST be eligible for importation in accordance with Transport Canada requirements.

Vehicle import registration fees may also apply.

Value (CDN Dollars)

K22 / Vehicle Import Form No.

Conveyances (make, model, serial number of vehicle, vessel, aircraft, or trailer)

1

2

3

Form B15 No. (if applicable)

Mover’s

No

Additional List of Goods

Form B4A

Other

Goods to Follow

Yes

Inventory

CLASSIFICATION TYPE – See information on reverse

FORMER RESIDENT (tariff item No. 9805.00.00)

BENEFICIARY (tariff item No. 9806.00.00)

I hereby declare that I have read and qualify for the provisions of tariff item

I hereby declare that I have read and qualify for the provisions of tariff item

No. 9806.00.00 and that I am a beneficiary of personal and household effects which

No. 9805.00.00 and that:

were bequeathed to me without remuneration as:

1.

I have been a resident of another country for at least one year; or

1.

The result of the death of

,

2.

I have been continuously absent from Canada for at least one year; and

a resident of

,

3.

I left Canada on _____________________ ; and

who died on

; or

4.

I returned to Canada to resume residence on _______________________ .

In anticipation of the death of

,

5.

With the exception of wedding gifts, bride’s trousseau, alcoholic beverages

who resides in

.

and tobacco products or replacement goods described in the Tariff Item

No. 9805.00.00 Exemption Order , all household and personal effects

imported or to be imported by me under this tariff item have been actually

I have attached:

owned, possessed, and used abroad by me for at least six months prior to

the date of my return to Canada to resume residence.

1.

A copy of the will, showing that I am a beneficiary of the estate;

6.

All goods imported are my personal or household effects and were not used

2.

A signed statement from the donor outlining the circumstances of the gift; or

abroad for any commercial purpose nor will they be used in Canada for any

3.

A statement from the executor of the estate or other legal reprresentative of

commercial purpose.

the donor outlining the circumstances of the gift.

7.

If any item is sold or otherwise disposed of in Canada within 12 months of

the date of its importation, I will notify a customs office of such fact and pay

all duties owing at the time.

SEASONAL RESIDENT (tariff item No. 9829.00.00)

SETTLER (tariff item No. 9807.00.00)

I hereby declare that I have read and qualify for the provisions of

I hereby declare that I have read and qualify for the provisions of tariff item

tariff item No. 9829.00.00 and that:

No. 9807.00.00 and that:

1.

I arrived in Canada to occupy my seasonal residence for the first time

1.

I am entering Canada with the intention of establishing, for the first time, a

permanent residence for a period in excess of 12 months and I arrived in

on __________________ .

Canada on __________________ .

2.

All goods imported or to be imported by me under this tariff item have been in my

ownership, possession, and use prior to my first arrival in Canada to occupy my

2.

With the exception of wedding gifts, bride’s trousseau, alcoholic beverages and

seasonal residence.

tobacco products described in the Tariff Item No. 9807.00.00 Exemption Order , all

household and personal effects imported or to be imported by me under this

3.

All goods imported are my personal or household property and they will not be used

tariff item have actually been owned, possessed, and used abroad by me prior to

in Canada for any commercial purpose.

the date of my arrival in Canada.

4.

If any item is sold or otherwise disposed of in Canada within 12 months of the date of

3.

All goods imported are my personal or household property and they will not be used

its importation, I will notify a customs office of such fact and pay all duties owing at

in Canada for any commercial purpose.

the time.

4.

If any item is sold or otherwise disposed of in Canada within 12 months of the

5.

I have not previously claimed the benefits of tariff item No. 9829.00.00.

date of its importation, I will notify a customs office of such fact and pay all duties

owing at the time.

Signed at

on

Signature of Importer

(Ce formulaire existe aussi en français )

B4 E (01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2