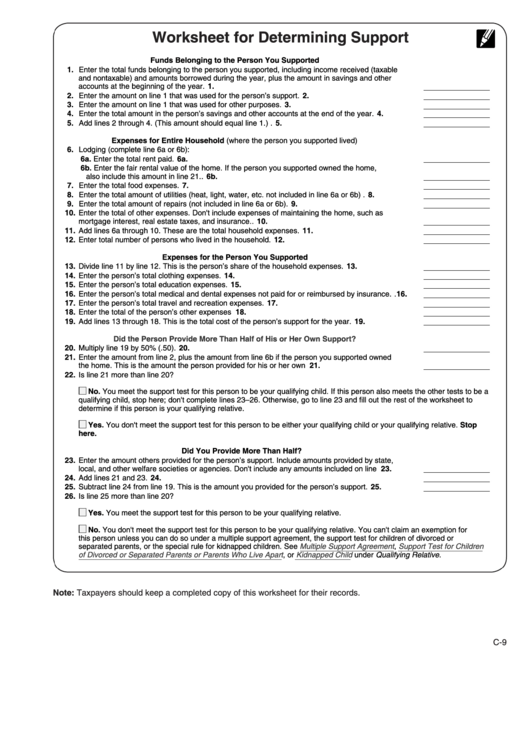

Worksheet for Determining Support

Funds Belonging to the Person You Supported

1. Enter the total funds belonging to the person you supported, including income received (taxable

and nontaxable) and amounts borrowed during the year, plus the amount in savings and other

accounts at the beginning of the year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Enter the amount on line 1 that was used for the person’s support . . . . . . . . . . . . . . . . . . . . . . 2.

3. Enter the amount on line 1 that was used for other purposes . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Enter the total amount in the person’s savings and other accounts at the end of the year . . . . . . 4.

5. Add lines 2 through 4. (This amount should equal line 1.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

Expenses for Entire Household (where the person you supported lived)

6. Lodging (complete line 6a or 6b):

6a. Enter the total rent paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6a.

6b. Enter the fair rental value of the home. If the person you supported owned the home,

also include this amount in line 21. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b.

7. Enter the total food expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Enter the total amount of utilities (heat, light, water, etc. not included in line 6a or 6b) . . . . . . . . . 8.

9. Enter the total amount of repairs (not included in line 6a or 6b) . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. Enter the total of other expenses. Don't include expenses of maintaining the home, such as

mortgage interest, real estate taxes, and insurance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

11. Add lines 6a through 10. These are the total household expenses . . . . . . . . . . . . . . . . . . . . . . 11.

12. Enter total number of persons who lived in the household . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

Expenses for the Person You Supported

13. Divide line 11 by line 12. This is the person’s share of the household expenses . . . . . . . . . . . . . 13.

14. Enter the person’s total clothing expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

15. Enter the person’s total education expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

16. Enter the person’s total medical and dental expenses not paid for or reimbursed by insurance . . 16.

17. Enter the person’s total travel and recreation expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

18. Enter the total of the person’s other expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

19. Add lines 13 through 18. This is the total cost of the person’s support for the year . . . . . . . . . . . 19.

Did the Person Provide More Than Half of His or Her Own Support?

20. Multiply line 19 by 50% (.50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.

21. Enter the amount from line 2, plus the amount from line 6b if the person you supported owned

the home. This is the amount the person provided for his or her own support . . . . . . . . . . . . . . . 21.

22. Is line 21 more than line 20?

No. You meet the support test for this person to be your qualifying child. If this person also meets the other tests to be a

qualifying child, stop here; don't complete lines 23 – 26. Otherwise, go to line 23 and fill out the rest of the worksheet to

determine if this person is your qualifying relative.

Yes. You don't meet the support test for this person to be either your qualifying child or your qualifying relative. Stop

here.

Did You Provide More Than Half?

23. Enter the amount others provided for the person’s support. Include amounts provided by state,

local, and other welfare societies or agencies. Don't include any amounts included on line 1. . . 23.

24. Add lines 21 and 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24.

25. Subtract line 24 from line 19. This is the amount you provided for the person’s support . . . . . . . . 25.

26. Is line 25 more than line 20?

Yes. You meet the support test for this person to be your qualifying relative.

No. You don't meet the support test for this person to be your qualifying relative. You can't claim an exemption for

this person unless you can do so under a multiple support agreement, the support test for children of divorced or

separated parents, or the special rule for kidnapped children. See

Multiple Support

Agreement,

Support Test for Children

of Divorced or Separated Parents or Parents Who Live

Apart, or

Kidnapped Child

under Qualifying Relative.

Note: Taxpayers should keep a completed copy of this worksheet for their records.

C-9

1

1