Year-End Meal Tally

ADVERTISEMENT

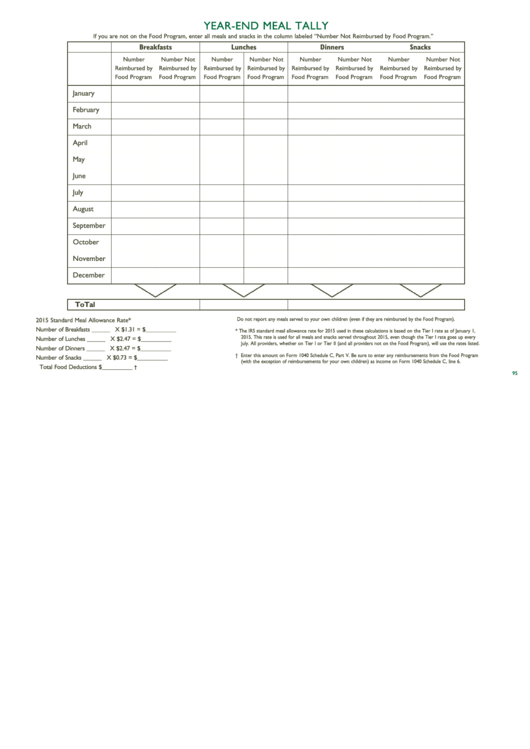

YEAR-END MEAL TALLY

If you are not on the Food Program, enter all meals and snacks in the column labeled “Number Not Reimbursed by Food Program.”

Breakfasts

Lunches

Dinners

Snacks

Number

Number Not

Number

Number Not

Number

Number Not

Number

Number Not

Reimbursed by

Reimbursed by

Reimbursed by

Reimbursed by

Reimbursed by

Reimbursed by

Reimbursed by

Reimbursed by

Food Program

Food Program

Food Program

Food Program

Food Program

Food Program

Food Program

Food Program

January

February

March

April

May

June

July

August

September

October

November

December

ToTal

Do not report any meals served to your own children (even if they are reimbursed by the Food Program).

2015 Standard Meal Allowance Rate*

Number of Breakfasts

______ X

$1.31

=

$__________

* The IRS standard meal allowance rate for 2015 used in these calculations is based on the Tier I rate as of January 1,

2015. This rate is used for all meals and snacks served throughout 2015, even though the Tier I rate goes up every

Number of Lunches

______ X $2.47

=

$__________

July. All providers, whether on Tier I or Tier II (and all providers not on the Food Program), will use the rates listed.

Number of Dinners

______ X $2.47

=

$__________

† Enter this amount on Form 1040 Schedule C, Part V. Be sure to enter any reimbursements from the Food Program

Number of Snacks

______ X $0.73

=

$__________

(with the exception of reimbursements for your own children) as income on Form 1040 Schedule C, line 6.

Total Food Deductions

$__________

†

95

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1