Page 1 of 3

S

C

tate of

alifornia

D

r

e

epartment of

eal

State

Providing Service, Protecting You

M

L

D

s

(t

)

ortgage

oan

iscLosure

tateMent

raDitionaL

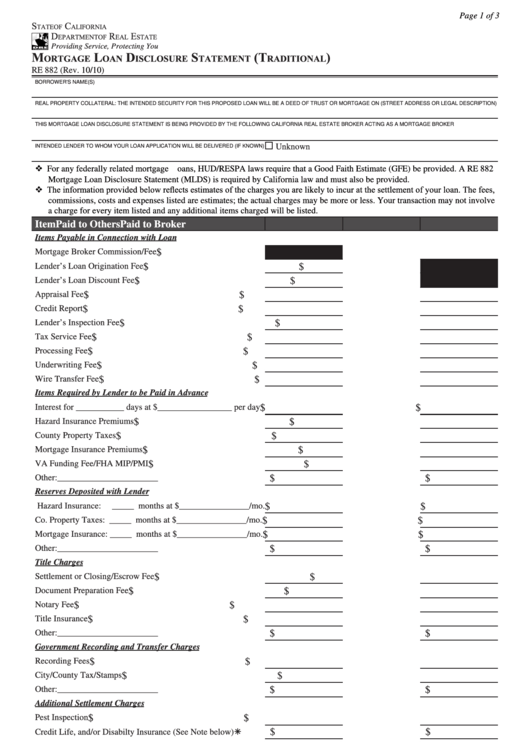

RE 882 (Rev. 10/10)

BORROWER'S NAME(S)

REAL PROPERTY COLLATERAL: THE INTENDED SECURITY FOR THIS PROPOSED LOAN WILL BE A DEED OF TRUST OR MORTGAGE ON (STREET ADDRESS OR LEGAL DESCRIPTION)

THIS MORTGAGE LOAN DISCLOSURE STATEMENT IS BEING PROVIDED BY THE FOLLOWING CALIFORNIA REAL ESTATE BROKER ACTING AS A MORTGAGE BROKER

¨

Unknown

INTENDED LENDER TO WHOM YOUR LOAN APPLICATION WILL BE DELIVERED (IF KNOWN)

For any federally related mortgage oans, HUD/RESPA laws require that a Good Faith Estimate (GFE) be provided. A RE 882

Mortgage Loan Disclosure Statement (MLDS) is required by California law and must also be provided.

The information provided below reflects estimates of the charges you are likely to incur at the settlement of your loan. The fees,

commissions, costs and expenses listed are estimates; the actual charges may be more or less. Your transaction may not involve

a charge for every item listed and any additional items charged will be listed.

Item

Paid to Others

Paid to Broker

Items Payable in Connection with Loan

Mortgage Broker Commission/Fee

$

$

Lender’s Loan Origination Fee

$

$

Lender’s Loan Discount Fee

$

$

Appraisal Fee

$

$

Credit Report

$

$

Lender’s Inspection Fee

$

$

Tax Service Fee

$

$

Processing Fee

$

$

Underwriting Fee

$

$

Wire Transfer Fee

$

$

Items Required by Lender to be Paid in Advance

Interest for ___________ days at $_________________ per day

$

$

Hazard Insurance Premiums

$

$

County Property Taxes

$

$

Mortgage Insurance Premiums

$

$

VA Funding Fee/FHA MIP/PMI

$

$

Other:_______________________

$

$

Reserves Deposited with Lender

Hazard Insurance:

_____ months at $________________/mo.

$

$

Co. Property Taxes: _____ months at $________________/mo.

$

$

Mortgage Insurance: _____ months at $________________/mo.

$

$

Other:_______________________

$

$

Title Charges

Settlement or Closing/Escrow Fee

$

$

Document Preparation Fee

$

$

Notary Fee

$

$

Title Insurance

$

$

Other:_______________________

$

$

Government Recording and Transfer Charges

Recording Fees

$

$

City/County Tax/Stamps

$

$

Other:_______________________

$

$

Additional Settlement Charges

Pest Inspection

$

$

$

$

Credit Life, and/or Disabilty Insurance (See Note below)

Subtotals of Initial Fees, Commissions, Costs and Expenses

$

$

Total of Initial Fees, Commissions, Costs and Expenses

$

Compensation to Broker (Not Paid Out of Loan Proceeds)

Yield Spread Premium, Service Release Premium or Other Rebate Received from Lender $___________________

Yield Spread Premium, Service Release Premium or Other Rebate Credited to Borrower $___________________

Total Amount of Compensation Retained by Broker

$___________________

Note: The purchase of Credit Life and/or Disability Insurance is NOT required as a condition of making this proposed loan.

1

1 2

2 3

3