Mortgage Comparison Worksheet Template

ADVERTISEMENT

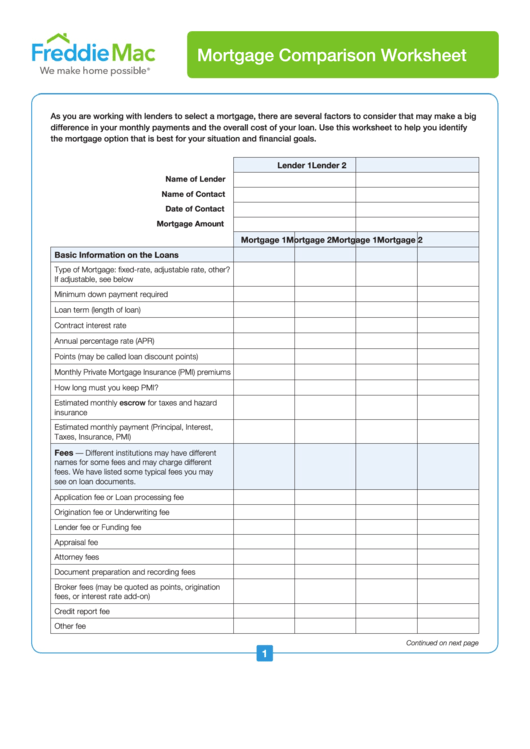

Mortgage Comparison Worksheet

As you are working with lenders to select a mortgage, there are several factors to consider that may make a big

difference in your monthly payments and the overall cost of your loan. Use this worksheet to help you identify

the mortgage option that is best for your situation and financial goals.

Lender 1

Lender 2

Name of Lender

Name of Contact

Date of Contact

Mortgage Amount

Mortgage 1

Mortgage 2

Mortgage 1

Mortgage 2

Basic Information on the Loans

Type of Mortgage: fixed-rate, adjustable rate, other?

If adjustable, see below

Minimum down payment required

Loan term (length of loan)

Contract interest rate

Annual percentage rate (APR)

Points (may be called loan discount points)

Monthly Private Mortgage Insurance (PMI) premiums

How long must you keep PMI?

Estimated monthly escrow for taxes and hazard

insurance

Estimated monthly payment (Principal, Interest,

Taxes, Insurance, PMI)

Fees

— Different institutions may have different

names for some fees and may charge different

fees. We have listed some typical fees you may

see on loan documents.

Application fee or Loan processing fee

Origination fee or Underwriting fee

Lender fee or Funding fee

Appraisal fee

Attorney fees

Document preparation and recording fees

Broker fees (may be quoted as points, origination

fees, or interest rate add-on)

Credit report fee

Other fee

Continued on next page

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3