What Can I Afford Worksheet

Download a blank fillable What Can I Afford Worksheet in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete What Can I Afford Worksheet with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

T h e P e g g y H i l l Te a m a t K e l l e r W i l l i a m s E x p e r i e n c e R e a l t y, B r o k e r a g e

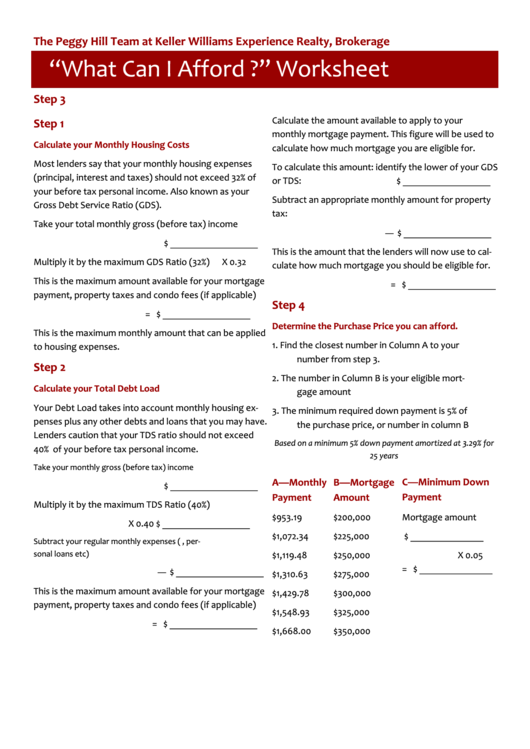

“What Can I Afford ?” Worksheet

Step 3

Calculate the amount available to apply to your

Step 1

monthly mortgage payment. This figure will be used to

Calculate your Monthly Housing Costs

calculate how much mortgage you are eligible for.

Most lenders say that your monthly housing expenses

To calculate this amount: identify the lower of your GDS

(principal, interest and taxes) should not exceed 32% of

or TDS:

$ __________________

your before tax personal income. Also known as your

Subtract an appropriate monthly amount for property

Gross Debt Service Ratio (GDS).

tax:

Take your total monthly gross (before tax) income

$ __________________

—

$ __________________

This is the amount that the lenders will now use to cal-

Multiply it by the maximum GDS Ratio (32%)

X 0.32

culate how much mortgage you should be eligible for.

This is the maximum amount available for your mortgage

= $ __________________

payment, property taxes and condo fees (if applicable)

Step 4

= $ __________________

Determine the Purchase Price you can afford.

This is the maximum monthly amount that can be applied

1.

Find the closest number in Column A to your

to housing expenses.

number from step 3.

Step 2

2.

The number in Column B is your eligible mort-

Calculate your Total Debt Load

gage amount

Your Debt Load takes into account monthly housing ex-

3.

The minimum required down payment is 5% of

penses plus any other debts and loans that you may have.

the purchase price, or number in column B

Lenders caution that your TDS ratio should not exceed

Based on a minimum 5% down payment amortized at 3.29% for

40% of your before tax personal income.

25 years

Take your monthly gross (before tax) income

A—Monthly

B—Mortgage

C—Minimum Down

$ __________________

Payment

Amount

Payment

Multiply it by the maximum TDS Ratio (40%)

Mortgage amount

$953.19

$200,000

X 0.40 $ __________________

$ _______________

$1,072.34

$225,000

Subtract your regular monthly expenses (i.e. car payments, per-

sonal loans etc)

X 0.05

$1,119.48

$250,000

= $ _______________

$ __________________

—

$1,310.63

$275,000

This is the maximum amount available for your mortgage

$1,429.78

$300,000

payment, property taxes and condo fees (if applicable)

$1,548.93

$325,000

= $ __________________

$1,668.00

$350,000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1