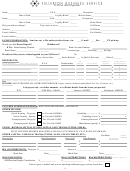

If an owner/manager, did the taxpayer have a shareholder loan outstanding during the year?

Yes

No

If yes, provide details of borrowings and repayments: ______________________________________________________________

If the taxpayer used a vehicle for business, are the vehicle expenses and both total and

business mileage attached?

Yes

No

If the taxpayer used a portion of his/her home for business, are the home expenses and

both total and business square footage attached?

Yes

No

Is a list of all new asset additions attached?

Yes

No

11.

Rental Income

If the taxpayer owned rental property, is a statement of rental income attached?

Yes

No

12.

RRSP Contributions

T-slip for contributions made attached?

Yes

No

13.

Other Credits

T2202 – Tuition/education amount for taxpayer?

Yes

No

T2202 – Tuition/education amount claimed on transfer from dependant?

Yes

No

Receipt or amount for taxpayer’s student loan interest?

Yes

No

Receipts/listing of all medical expenses paid in the year for taxpayer,

spouse, and dependants?

Yes

No

Receipts for charitable donations or donations made by way of gifting an item in kind?

Yes

No

Were any loans associated with the charitable donations?

Yes

No

Receipts for political contributions?

Yes

No

Tickets for public transit?

Yes

No

Receipts/listing for fitness and extracurricular activity amounts paid for each child?

Yes

No

Statement for new home to claim the home buyer’s amount?

Yes

No

Amount of property taxes/rent paid in the year?

Yes

No

14.

Prior Year Tax Return Information/Correspondence

Is a copy of the Notice of Assessment for last year’s tax return attached?

Yes

No

If new to the firm, are tax returns (and corresponding Notices of Assessment)

for the last three years attached?

Yes

No

If taxpayer claimed a loss carryback in any of the preceding 3 years,

are the Notices of Reassessment for those years attached?

Yes

No

Is a copy of any other correspondence from the Canada Revenue Agency

attached?

Yes

No

If you would like your tax refund deposited directly into your account, is a void

cheque attached?

Yes

No

Is your statement of instalments paid for the year attached?

Yes

No

1

1 2

2 3

3