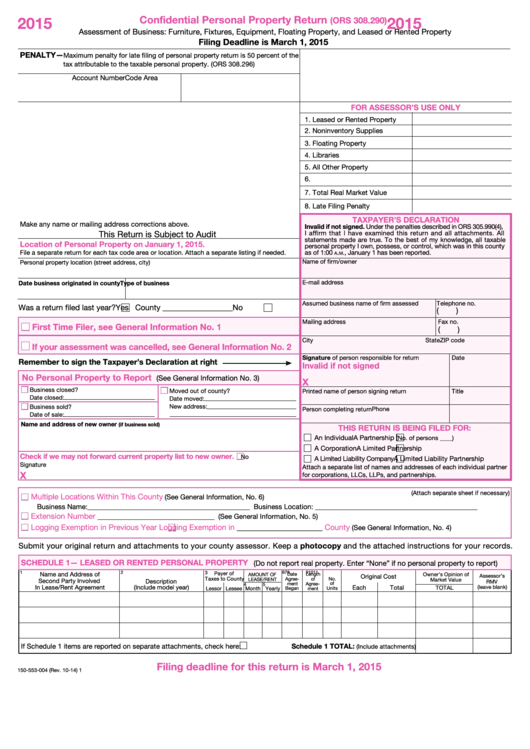

2015

Confidential Personal Property Return

2015

(ORS 308.290)

Assessment of Business: Furniture, Fixtures, Equipment, Floating Property, and Leased or Rented Property

Filing Deadline is March 1, 2015

PENALTY—

Maximum penalty for late filing of personal property return is 50 percent of the

tax attributable to the taxable personal property. (ORS 308.296)

Clear this page

Account Number

Code Area

FOR ASSESSOR’S USE ONLY

1. Leased or Rented Property

2. Noninventory Supplies

3. Floating Property

4. Libraries

5. All Other Property

6.

7. Total Real Market Value

8. Late Filing Penalty

TAXPAYER’S DECLARATION

Make any name or mailing address corrections above.

Invalid if not signed. Under the penalties described in ORS 305.990(4),

This Return is Subject to Audit

I affirm that I have examined this return and all attachments. All

statements made are true. To the best of my knowledge, all taxable

Location of Personal Property on January 1, 2015.

personal property I own, possess, or control, which was in this county

File a separate return for each tax code area or location. Attach a separate listing if needed.

as of 1:00

.

., January 1 has been reported.

a

m

Name of firm/owner

Personal property location (street address, city)

E-mail address

Date business originated in county

Type of business

Assumed business name of firm assessed

Telephone no.

Was a return filed last year?

Yes County __________________

No

(

)

Mailing address

Fax no.

First Time Filer, see General Information No. 1

(

)

City

State

ZIP code

If your assessment was cancelled, see General Information No. 2

Signature of person responsible for return

Date

Remember to sign the Taxpayer’s Declaration at right

Invalid if not signed

No Personal Property to Report

(See General Information No. 3)

X

Business closed?

Moved out of county?

Printed name of person signing return

Title

Date closed:

Date moved:

Business sold?

New address:

Phone

Person completing return

Date of sale:

Name and address of new owner

(if business sold)

THIS RETURN IS BEING FILED FOR:

An Individual

A Partnership

(No. of persons ____)

A Corporation

A Limited Partnership

Check if we may not forward current property list to new owner.

No

A Limited Liability Company

A Limited Liability Partnership

Signature

Attach a separate list of names and addresses of each individual partner

X

for corporations, LLCs, LLPs, and partnerships.

(Attach separate sheet if necessary)

Multiple Locations Within This County

(See General Information, No. 6)

Business Name:______________________________________________ Business Location: ______________________________________________

Extension Number

______________________________

(See General Information, No. 5)

Logging Exemption in Previous Year

Logging Exemption in

______________________

County

(See General Information, No. 4)

Submit your original return and attachments to your county assessor. Keep a photocopy and the attached instructions for your records.

SCHEDULE 1— LEASED OR RENTED PERSONAL PROPERTY

(Do not report real property. Enter “None” if no personal property to report)

3

1

2

Payer of

6

7

8

9

10

11

Name and Address of

Date

Length

Owner’s Opinion of

AMOUNT OF

Original Cost

Assessor’s

Taxes to County

Agree-

of

No.

LEASE/RENT

Market Value

Second Party Involved

Description

RMV

of

ment

Agree-

4

5

In Lease/Rent Agreement

(Include model year)

Each

Total

TOTAL

(leave blank)

Lessor Lessee

Month Yearly

Began

Units

ment

If Schedule 1 items are reported on separate attachments, check here:

Schedule 1 TOTAL:

(Include attachments)

Filing deadline for this return is March 1, 2015

150-553-004 (Rev. 10-14)

1

1

1 2

2 3

3 4

4