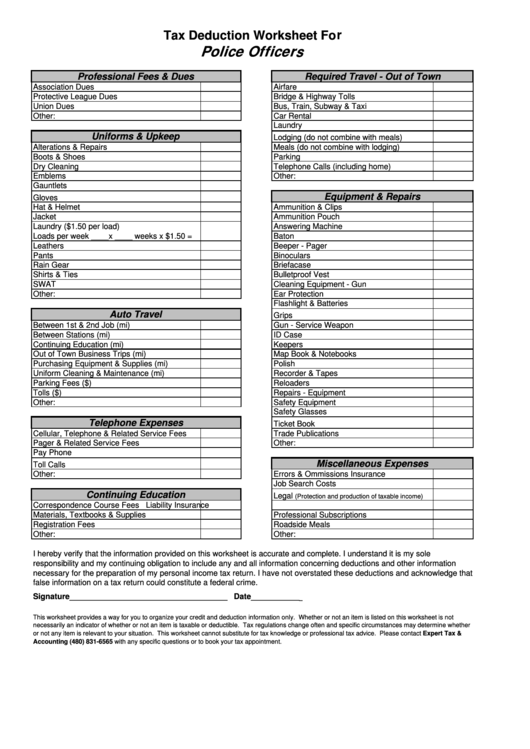

Tax Deduction Worksheet For

Police Officers

Professional Fees & Dues

Required Travel - Out of Town

Association Dues

Airfare

Protective League Dues

Bridge & Highway Tolls

Union Dues

Bus, Train, Subway & Taxi

Other:

Car Rental

Laundry

Uniforms & Upkeep

Lodging (do not combine with meals)

Alterations & Repairs

Meals (do not combine with lodging)

Boots & Shoes

Parking

Dry Cleaning

Telephone Calls (including home)

Emblems

Other:

Gauntlets

Equipment & Repairs

Gloves

Hat & Helmet

Ammunition & Clips

Jacket

Ammunition Pouch

Laundry ($1.50 per load)

Answering Machine

Loads per week ____x ____ weeks x $1.50 =

Baton

Leathers

Beeper - Pager

Pants

Binoculars

Rain Gear

Briefacase

Shirts & Ties

Bulletproof Vest

SWAT

Cleaning Equipment - Gun

Other:

Ear Protection

Flashlight & Batteries

Auto Travel

Grips

Between 1st & 2nd Job (mi)

Gun - Service Weapon

Between Stations (mi)

ID Case

Continuing Education (mi)

Keepers

Out of Town Business Trips (mi)

Map Book & Notebooks

Purchasing Equipment & Supplies (mi)

Polish

Uniform Cleaning & Maintenance (mi)

Recorder & Tapes

Parking Fees ($)

Reloaders

Tolls ($)

Repairs - Equipment

Other:

Safety Equipment

Safety Glasses

Telephone Expenses

Ticket Book

Cellular, Telephone & Related Service Fees

Trade Publications

Pager & Related Service Fees

Other:

Pay Phone

Miscellaneous Expenses

Toll Calls

Other:

Errors & Ommissions Insurance

Job Search Costs

Continuing Education

Legal

(Protection and production of taxable income)

Correspondence Course Fees

Liability Insurance

Materials, Textbooks & Supplies

Professional Subscriptions

Registration Fees

Roadside Meals

Other:

Other:

I hereby verify that the information provided on this worksheet is accurate and complete. I understand it is my sole

responsibility and my continuing obligation to include any and all information concerning deductions and other information

necessary for the preparation of my personal income tax return. I have not overstated these deductions and acknowledge that

false information on a tax return could constitute a federal crime.

Signature____________________________________ Date____________

This worksheet provides a way for you to organize your credit and deduction information only. Whether or not an item is listed on this worksheet is not

necessarily an indicator of whether or not an item is taxable or deductible. Tax regulations change often and specific circumstances may determine whether

or not any item is relevant to your situation. This worksheet cannot substitute for tax knowledge or professional tax advice. Please contact Expert Tax &

Accounting (480) 831-6565 with any specific questions or to book your tax appointment.

1

1