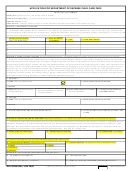

Dd Form 2652 - Application For Department Of Defense Child Care Fees Page 3

ADVERTISEMENT

INSTRUCTIONS

Per Department of Defense Instruction 6060.02, Child Development Programs, this form is utilized to determine fees for DoD Child

Care Programs.

To determine child care fees for your child(ren), or and child(ren) you legally claim as dependents, this from must be completed, signed

and returned to the facility for which your child is enrolling.

Fees are determined based on your Total Family Income (TFI) as defined below. If you choose not to disclose your family income,

your rate for child care will be set at the highest fee level.

Total Family Income (TFI) - For the purpose of determining child care fees in DoD Child Development Programs, total family income is

defined as all earned income including wages, salaries, tips, special duty pay (flight pay, active duty demo pay, sea pay) and active

duty save pay, long-term disability benefits, voluntary salary deferrals, retirement or other pension income including SSI paid to the

spouse and VA benefits paid to the surviving spouse before deductions for taxes. TFI calculations must also include quarters

subsistence and other allowances appropriate for the rank and status of military or civilian personnel whether received in cash or in

kind.

DO NOT INCLUDE alimony, and child support received by the custodial parent, SSI received on behalf of the dependent child,

reimbursements for educational expenses or health and wellness benefits, cost of living (COLA) received in high cost areas, temporary

duty allowances, or reenlistment bonuses.

For households in which unmarried couples or pairs are living as a family, the income for both adults should be used to determine Total

Family Income (TFI).

Sections I, II, and III are to be completed by the sponsor or their designee.

Section I.

1. Provide the last name, first name and middle initial for each child who is receiving care in a DoD child care program.

2. Provide the date of birth for each child who is receiving care in a DoD child care program.

3. Provide the age of each child on the date of application who is receiving care in a DoD child care program.

4. Provide the type of care being request or in which each child is currently enrolled.

Section II.

When completing Section II, include all military and civilian income for both the sponsor and spouse or other adult living in the home.

5.a. Provide the sponsor’s last name, first name and middle initial.

5.b. Provide the total years of military/civilian service as applicable.

5.c.(1) Provide your most recent income data and indicate if income is received weekly, biweekly, monthly or twice per month.

5.c.(2) Provide the current year BAH RT/C. For dual military living in government quarters include BAH RC/T of the senior member

only; in locations where military members receive less than the BAH RC/T allowance, use the local BAH rate; for Defense civilian

OCONUS include either the housing allowance or the value of the in-kind housing.

5.c.(3). Provide the basic subsistence allowance or in-kind equivalent.

5.c.(4) Provide any other earned income.

5.c.(5) To be completed by program staff.

6.a. Provide the last name, first name and middle initial of the spouse or other adult living in the home, who contributes to the welfare

of the child.

6.b. Provide the income of the spouse or other adult living in the home, who contributes to the welfare of the child.

7. Provide any additional income.

8. To be completed by program staff.

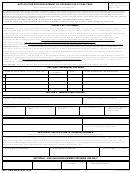

Section III.

9. Provide the sponsor's signature.

10. Provide the spouse's or other resident adult's signature.

11. Provide the date of signatures.

DD FORM 2652 (BACK), MAY 2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3