Nursing Professional Deductions Form

ADVERTISEMENT

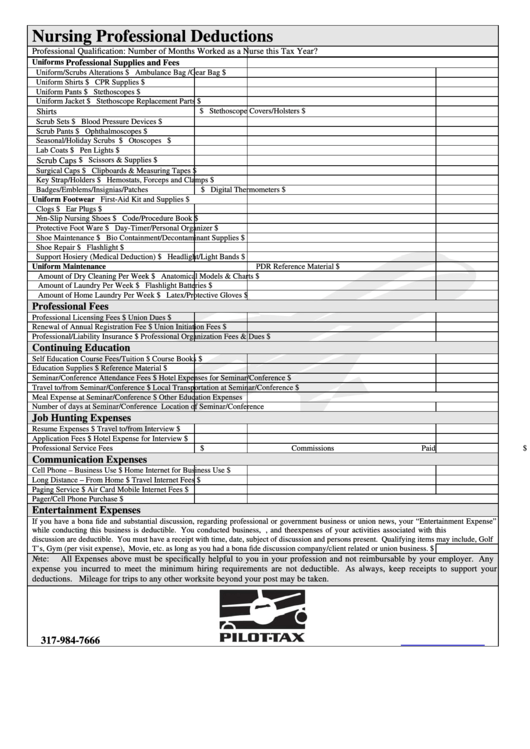

Nursing Professional Deductions

Professional Qualification:

Number of Months Worked as a Nurse this Tax Year?

Uniforms

Professional Supplies and Fees

Uniform/Scrubs Alterations

$

Ambulance Bag /Gear Bag

$

Uniform Shirts

$

CPR Supplies

$

Uniform Pants

$

Stethoscopes

$

Uniform Jacket

$

Stethoscope Replacement Parts

$

$

Stethoscope Covers/Holsters

$

Shirts

Scrub Sets

$

Blood Pressure Devices

$

Scrub Pants

$

Ophthalmoscopes

$

Seasonal/Holiday Scrubs

$

Otoscopes

$

Lab Coats

$

Pen Lights

$

$

Scissors & Supplies

$

Scrub Caps

Surgical Caps

$

Clipboards & Measuring Tapes

$

Key Strap/Holders

$

Hemostats, Forceps and Clamps

$

Badges/Emblems/Insignias/Patches

$

Digital Thermometers

$

Uniform Footwear

First-Aid Kit and Supplies

$

Clogs

$

Ear Plugs

$

Non-Slip Nursing Shoes

$

Code/Procedure Book

$

Protective Foot Ware

$

Day-Timer/Personal Organizer

$

Shoe Maintenance

$

Bio Containment/Decontaminant Supplies

$

Shoe Repair

$

Flashlight

$

Support Hosiery (Medical Deduction)

$

Headlight/Light Bands

$

Uniform Maintenance

PDR Reference Material

$

Amount of Dry Cleaning Per Week

$

Anatomical Models & Charts

$

Amount of Laundry Per Week

$

Flashlight Batteries

$

Amount of Home Laundry Per Week

$

Latex/Protective Gloves

$

Professional Fees

Professional Licensing Fees

$

Union Dues

$

Renewal of Annual Registration Fee

$

Union Initiation Fees

$

Professional/Liability Insurance

$

Professional Organization Fees & Dues

$

Continuing Education

Self Education Course Fees/Tuition

$

Course Books

$

Education Supplies

$

Reference Material

$

Seminar/Conference Attendance Fees

$

Hotel Expenses for Seminar/Conference

$

Travel to/from Seminar/Conference

$

Local Transportation at Seminar/Conference

$

Meal Expense at Seminar/Conference

$

Other Education Expenses

Number of days at Seminar/Conference

Location of Seminar/Conference

Job Hunting Expenses

Resume Expenses

$

Travel to/from Interview

$

Application Fees

$

Hotel Expense for Interview

$

Professional Service Fees

$

Commissions Paid

$

Communication Expenses

Cell Phone – Business Use

$

Home Internet for Business Use

$

Long Distance – From Home

$

Travel Internet Fees

$

Paging Service

$

Air Card Mobile Internet Fees

$

Pager/Cell Phone Purchase

$

Entertainment Expenses

If you have a bona fide and substantial discussion, regarding professional or government business or union news, your “Entertainment Expense”

while conducting this business is deductible. You conducted business, i.e. discussed it, and the expenses of your activities associated with this

discussion are deductible. You must have a receipt with time, date, subject of discussion and persons present. Qualifying items may include, Golf

T’s, Gym (per visit expense), Movie, etc. as long as you had a bona fide discussion company/client related or union business.

$

Note:

All Expenses above must be specifically helpful to you in your profession and not reimbursable by your employer. Any

expense you incurred to meet the minimum hiring requirements are not deductible. As always, keep receipts to support your

deductions. Mileage for trips to any other worksite beyond your post may be taken.

317-984-7666

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2