Form 15g - Declaration Under Section 197a (1) And Section 197a(1a)

ADVERTISEMENT

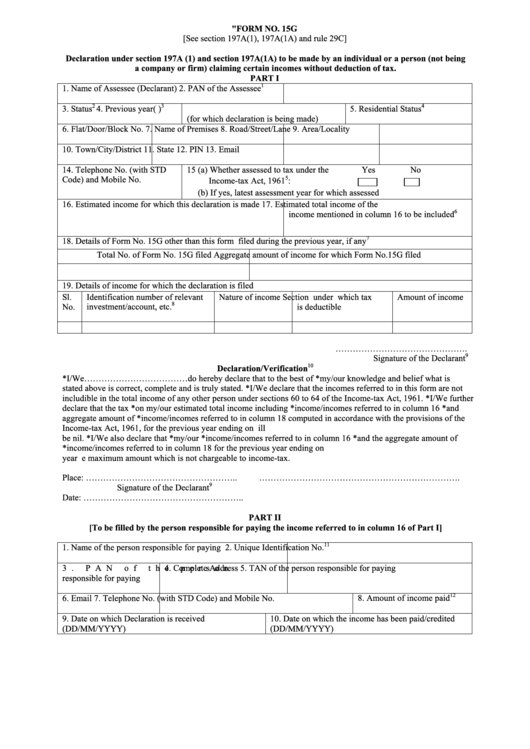

"FORM NO. 15G

[See section 197A(1), 197A(1A) and rule 29C]

Declaration under section 197A (1) and section 197A(1A) to be made by an individual or a person (not being

a company or firm) claiming certain incomes without deduction of tax.

PART I

1

1. Name of Assessee (Declarant)

2. PAN of the Assessee

2

3

4

3. Status

4. Previous year(P.Y.)

5. Residential Status

(for which declaration is being made)

6. Flat/Door/Block No.

7. Name of Premises

8. Road/Street/Lane

9. Area/Locality

10. Town/City/District

11. State

12. PIN

13. Email

14. Telephone No. (with STD

15 (a) Whether assessed to tax under the

Yes

No

Code) and Mobile No.

5

Income-tax Act, 1961

:

(b) If yes, latest assessment year for which assessed

16. Estimated income for which this declaration is made

17. Estimated total income of the P.Y. in which

6

income mentioned in column 16 to be included

7

18. Details of Form No. 15G other than this form filed during the previous year, if any

Total No. of Form No. 15G filed

Aggregate amount of income for which Form No.15G filed

19. Details of income for which the declaration is filed

Sl.

Identification number of relevant

Nature of income

Section under which tax

Amount of income

8

No.

investment/account, etc.

is deductible

……………………………………….

9

Signature of the Declarant

10

Declaration/Verification

*I/We………………………………do hereby declare that to the best of *my/our knowledge and belief what is

stated above is correct, complete and is truly stated. *I/We declare that the incomes referred to in this form are not

includible in the total income of any other person under sections 60 to 64 of the Income-tax Act, 1961. *I/We further

declare that the tax *on my/our estimated total income including *income/incomes referred to in column 16 *and

aggregate amount of *income/incomes referred to in column 18 computed in accordance with the provisions of the

Income-tax Act, 1961, for the previous year ending on .................... relevant to the assessment year ..................will

be nil. *I/We also declare that *my/our *income/incomes referred to in column 16 *and the aggregate amount of

*income/incomes referred to in column 18 for the previous year ending on .................... relevant to the assessment

year .................. will not exceed the maximum amount which is not chargeable to income-tax.

Place: ……………………………………………..

…………………………………………………………….

9

Signature of the Declarant

Date: ………………………………………………..

PART II

[To be filled by the person responsible for paying the income referred to in column 16 of Part I]

11

1. Name of the person responsible for paying

2. Unique Identification No.

3. PAN of the person

4. Complete Address

5. TAN of the person responsible for paying

responsible for paying

12

6. Email

7. Telephone No. (with STD Code) and Mobile No.

8. Amount of income paid

9.

Date

on

which

Declaration

is

received

10. Date on which the income has been paid/credited

(DD/MM/YYYY)

(DD/MM/YYYY)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2