Reset

Print

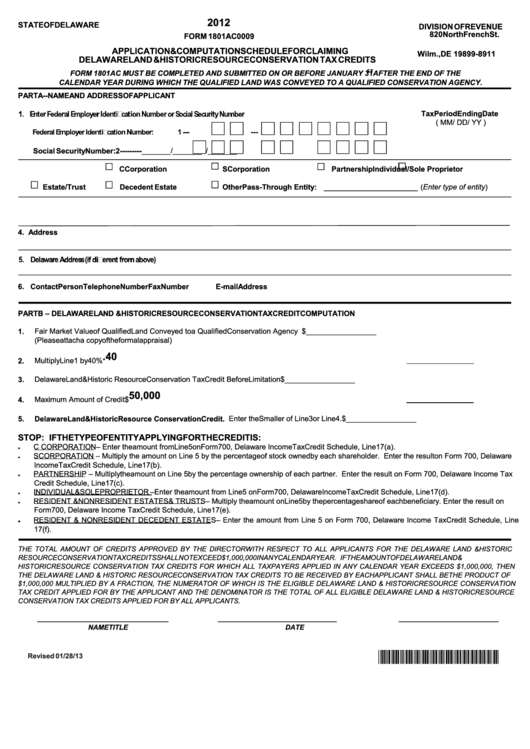

2012

STATEOFDELAWARE

DIVISION OFREVENUE

820 North French St.

FORM 1801AC0009

P.O. Box8911

APPLICATION &COMPUTATION SCHEDULEFORCLAIMING

Wilm., DE 19899-8911

DELAWARELAND &HISTORICRESOURCECONSERVATION TAXCREDITS

ST

FORM 1801AC MUST BE COMPLETED AND SUBMITTED ON OR BEFORE JANUARY 31 AFTER THE END OF THE

CALENDAR YEAR DURING WHICH THE QUALIFIED LAND WAS CONVEYED TO A QUALIFIED CONSERVATION AGENCY.

PAR TA-- NAMEAND ADDR ESSOFAPPLICANT

TaxPeriod Ending Date

( MM / DD / YY )

---

Social SecurityNumber:

2 ---

---

---

_______ / _______ /_______

2. Type of Entity

CCorporation

SCorporation

Partnership

Individual/Sole Proprietor

Estate/Trust

Decedent Estate

Other Pass-Through Entity:

(Enter type of entity)

3. Name of Applicant

4. Address

6. Contact Person

Telephone Number

FaxNumber

E -mail Address

PAR TB – DELAWAR ELAND &HISTOR ICR ESOUR CECONSER VATION TAXCR EDITCOMPUTATION

1.

Fair Market Value of Qualified Land Conveyed to a Qualified Conservation Agency

$

_________________

(Please attach a copy of the formal appraisal)

.40

2.

Multiply Line 1 by 40%

Delaware Land & Historic Resource Conservation Tax Credit Before Limitation

$

_________________

3.

50,000

4.

Maximum Amount of Credit

$

5. Delaware Land &HistoricR esource Conservation Credit.

Enter the Smaller of Line 3 or Line 4.

$

_________________

STOP: IFTHETYPEOFENTITYAPPLYINGFORTHECREDITIS:

C CORPORATION – Enter the amount from Line 5 on Form 700, Delaware Income Tax Credit Schedule, Line 17(a).

•

S CORPORATION – Multiply the amount on Line 5 by the percentage of stock owned by each shareholder. Enter the result on Form 700, Delaware

•

Income Tax Credit Schedule, Line 17(b).

PARTNERSHIP – Multiply the amount on Line 5 by the percentage ownership of each partner. Enter the result on Form 700, Delaware Income Tax

•

Credit Schedule, Line 17(c).

INDIVIDUAL & SOLE PROPRIETOR – Enter the amount from Line 5 on Form 700, Delaware Income Tax Credit Schedule, Line 17(d).

•

RESIDENT & NONRESIDENT ESTATES & TRUSTS – Multiply the amount on Line 5 by the percentage share of each beneficiary. Enter the result on

•

Form 700, Delaware Income Tax Credit Schedule, Line 17(e).

•

RESIDENT & NONRESIDENT DECEDENT ESTATES – Enter the amount from Line 5 on Form 700, Delaware Income Tax Credit Schedule, Line

17(f).

THE TOTAL AMOUNT OF CREDITS APPROVED BY THE DIRECTOR WITH RESPECT TO ALL APPLICANTS FOR THE DELAWARE LAND & HISTORIC

RESOURCE CONSERVATION TAX CREDITS SHALL NOT EXCEED $1,000,000 IN ANY CALENDAR YEAR. IF THE AMOUNT OF DELAWARE LAND &

HISTORIC RESOURCE CONSERVATION TAX CREDITS FOR WHICH ALL TAXPAYERS APPLIED IN ANY CALENDAR YEAR EXCEEDS $1,000,000, THEN

THE DELAWARE LAND & HISTORIC RESOURCE CONSERVATION TAX CREDITS TO BE RECEIVED BY EACH APPLICANT SHALL BE THE PRODUCT OF

$1,000,000 MULTIPLIED BY A FRACTION, THE NUMERATOR OF WHICH IS THE ELIGIBLE DELAWARE LAND & HISTORIC RESOURCE CONSERVATION

TAX CREDIT APPLIED FOR BY THE APPLICANT AND THE DENOMINATOR IS THE TOTAL OF ALL ELIGIBLE DELAWARE LAND & HISTORIC RESOURCE

CONSERVATION TAX CREDITS APPLIED FOR BY ALL APPLICANTS.

NAME

TITLE

DATE

*DF41712019999*

Revised 01/28/13

1

1 2

2