(Sample) Short Form Accountable Reimbursement Policy

ADVERTISEMENT

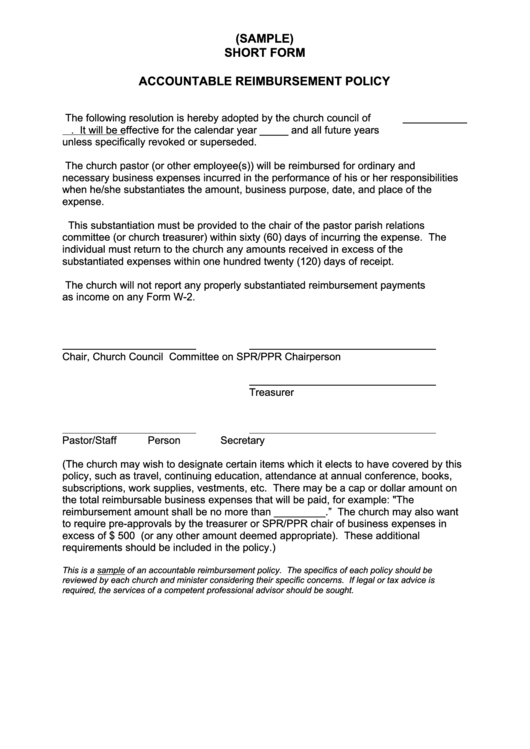

(SAMPLE)

SHORT FORM

ACCOUNTABLE REIMBURSEMENT POLICY

The following resolution is hereby adopted by the church council of

. It will be effective for the calendar year _____ and all future years

unless specifically revoked or superseded.

The church pastor (or other employee(s)) will be reimbursed for ordinary and

necessary business expenses incurred in the performance of his or her responsibilities

when he/she substantiates the amount, business purpose, date, and place of the

expense.

This substantiation must be provided to the chair of the pastor parish relations

committee (or church treasurer) within sixty (60) days of incurring the expense. The

individual must return to the church any amounts received in excess of the

substantiated expenses within one hundred twenty (120) days of receipt.

The church will not report any properly substantiated reimbursement payments

as income on any Form W-2.

Chair, Church Council

Committee on SPR/PPR Chairperson

Treasurer

Pastor/Staff Person

Secretary

(The church may wish to designate certain items which it elects to have covered by this

policy, such as travel, continuing education, attendance at annual conference, books,

subscriptions, work supplies, vestments, etc. There may be a cap or dollar amount on

the total reimbursable business expenses that will be paid, for example: "The

reimbursement amount shall be no more than _________.” The church may also want

to require pre-approvals by the treasurer or SPR/PPR chair of business expenses in

excess of $ 500 (or any other amount deemed appropriate). These additional

requirements should be included in the policy.)

This is a sample of an accountable reimbursement policy. The specifics of each policy should be

reviewed by each church and minister considering their specific concerns. If legal or tax advice is

required, the services of a competent professional advisor should be sought.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1