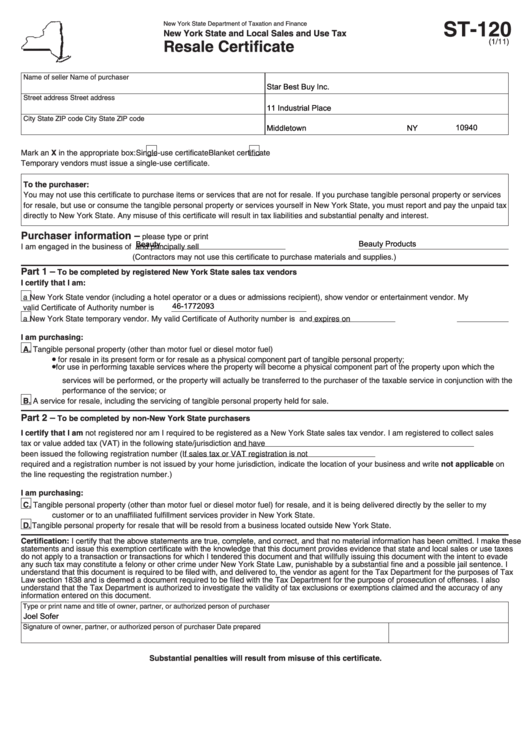

ST-120

New York State Department of Taxation and Finance

New York State and Local Sales and Use Tax

Resale Certificate

(1/11)

Name of seller

Name of purchaser

Star Best Buy Inc.

Street address

Street address

11 Industrial Place

City

State

ZIP code

City

State

ZIP code

10940

Middletown

NY

Mark an X in the appropriate box:

Single-use certificate

Blanket certificate

Temporary vendors must issue a single-use certificate.

To the purchaser:

You may not use this certificate to purchase items or services that are not for resale. If you purchase tangible personal property or services

for resale, but use or consume the tangible personal property or services yourself in New York State, you must report and pay the unpaid tax

directly to New York State. Any misuse of this certificate will result in tax liabilities and substantial penalty and interest.

Purchaser information –

please type or print

Beauty

Beauty Products

I am engaged in the business of

and principally sell

(Contractors may not use this certificate to purchase materials and supplies.)

Part 1 –

To be completed by registered New York State sales tax vendors

I certify that I am:

a New York State vendor (including a hotel operator or a dues or admissions recipient), show vendor or entertainment vendor. My

46-1772093

valid Certificate of Authority number is

a New York State temporary vendor. My valid Certificate of Authority number is

and expires on

I am purchasing:

A. Tangible personal property (other than motor fuel or diesel motor fuel)

•

for resale in its present form or for resale as a physical component part of tangible personal property;

•

for use in performing taxable services where the property will become a physical component part of the property upon which the

services will be performed, or the property will actually be transferred to the purchaser of the taxable service in conjunction with the

performance of the service; or

B. A service for resale, including the servicing of tangible personal property held for sale.

Part 2 –

To be completed by non-New York State purchasers

I certify that I am not registered nor am I required to be registered as a New York State sales tax vendor. I am registered to collect sales

tax or value added tax (VAT) in the following state/jurisdiction

and have

been issued the following registration number

(If sales tax or VAT registration is not

required and a registration number is not issued by your home jurisdiction, indicate the location of your business and write not applicable on

the line requesting the registration number.)

I am purchasing:

C. Tangible personal property (other than motor fuel or diesel motor fuel) for resale, and it is being delivered directly by the seller to my

customer or to an unaffiliated fulfillment services provider in New York State.

D. Tangible personal property for resale that will be resold from a business located outside New York State.

Certification: I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make these

statements and issue this exemption certificate with the knowledge that this document provides evidence that state and local sales or use taxes

do not apply to a transaction or transactions for which I tendered this document and that willfully issuing this document with the intent to evade

any such tax may constitute a felony or other crime under New York State Law, punishable by a substantial fine and a possible jail sentence. I

understand that this document is required to be filed with, and delivered to, the vendor as agent for the Tax Department for the purposes of Tax

Law section 1838 and is deemed a document required to be filed with the Tax Department for the purpose of prosecution of offenses. I also

understand that the Tax Department is authorized to investigate the validity of tax exclusions or exemptions claimed and the accuracy of any

information entered on this document.

Type or print name and title of owner, partner, or authorized person of purchaser

Joel Sofer

Signature of owner, partner, or authorized person of purchaser

Date prepared

Substantial penalties will result from misuse of this certificate.

1

1