Financial Planning For Deployment

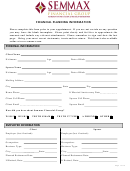

ADVERTISEMENT

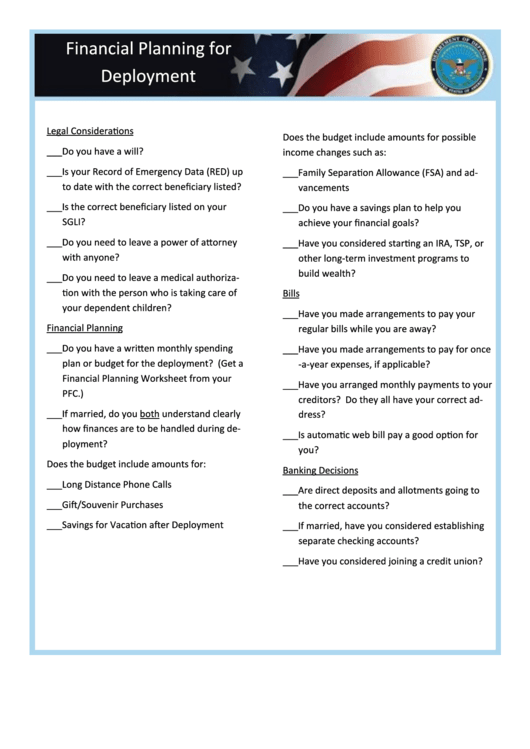

Financial Planning for

Deployment

Legal Considerations

Does the budget include amounts for possible

___Do you have a will?

income changes such as:

___Is your Record of Emergency Data (RED) up

___Family Separation Allowance (FSA) and ad-

to date with the correct beneficiary listed?

vancements

___Is the correct beneficiary listed on your

___Do you have a savings plan to help you

SGLI?

achieve your financial goals?

___Do you need to leave a power of attorney

___Have you considered starting an IRA, TSP, or

with anyone?

other long-term investment programs to

build wealth?

___Do you need to leave a medical authoriza-

tion with the person who is taking care of

Bills

your dependent children?

___Have you made arrangements to pay your

Financial Planning

regular bills while you are away?

___Do you have a written monthly spending

___Have you made arrangements to pay for once

plan or budget for the deployment? (Get a

-a-year expenses, if applicable?

Financial Planning Worksheet from your

___Have you arranged monthly payments to your

PFC.)

creditors? Do they all have your correct ad-

___If married, do you both understand clearly

dress?

how finances are to be handled during de-

___Is automatic web bill pay a good option for

ployment?

you?

Does the budget include amounts for:

Banking Decisions

___Long Distance Phone Calls

___Are direct deposits and allotments going to

___Gift/Souvenir Purchases

the correct accounts?

___Savings for Vacation after Deployment

___If married, have you considered establishing

separate checking accounts?

___Have you considered joining a credit union?

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2