Sample Debt Snowball Worksheet Template

ADVERTISEMENT

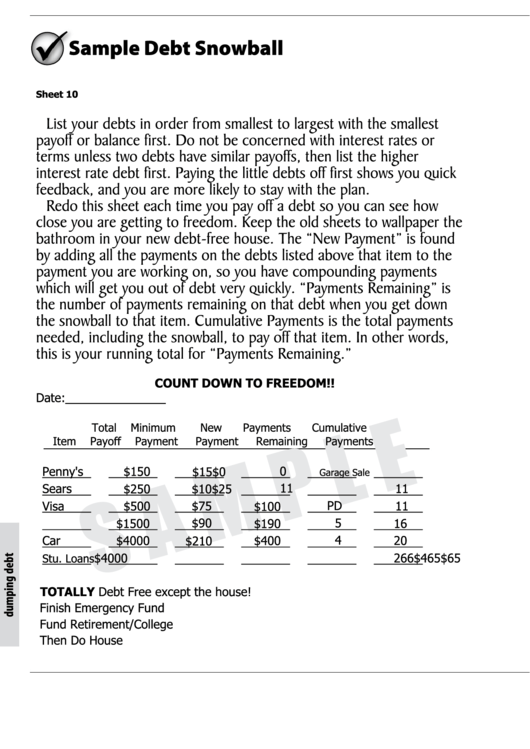

Sample Debt Snowball

Sheet 10

List your debts in order from smallest to largest with the smallest

payoff or balance first. Do not be concerned with interest rates or

terms unless two debts have similar payoffs, then list the higher

interest rate debt first. Paying the little debts off first shows you quick

feedback, and you are more likely to stay with the plan.

Redo this sheet each time you pay off a debt so you can see how

close you are getting to freedom. Keep the old sheets to wallpaper the

bathroom in your new debt-free house. The “New Payment” is found

by adding all the payments on the debts listed above that item to the

payment you are working on, so you have compounding payments

which will get you out of debt very quickly. “Payments Remaining” is

the number of payments remaining on that debt when you get down

the snowball to that item. Cumulative Payments is the total payments

needed, including the snowball, to pay off that item. In other words,

this is your running total for “Payments Remaining.”

CoUNT doWN To FREEdoM!!

Date:_______________

Total

Minimum

New

Payments

Cumulative

Item

Payoff

Payment

Payment

Remaining

Payments

0

Penny's

$150

$15

$0

________

________

________

________

________

________

Garage Sale

11

Sears

$250

$10

$25

11

________

________

________

________

________

________

PD

Visa

$500

$75

$100

11

________

________

________

________

________

________

$90

5

M.C.

$1500

16

$190

________

________

________

________

________

________

4

20

Car

$4000

$210

$400

________

________

________

________

________

________

$65

$465

6

26

$4000

Stu. Loans

________

________

________

________

________

________

ToTALLY Debt Free except the house!

Finish Emergency Fund

Fund Retirement/College

Then Do House

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1 2

2