Close

This form is available electronically.

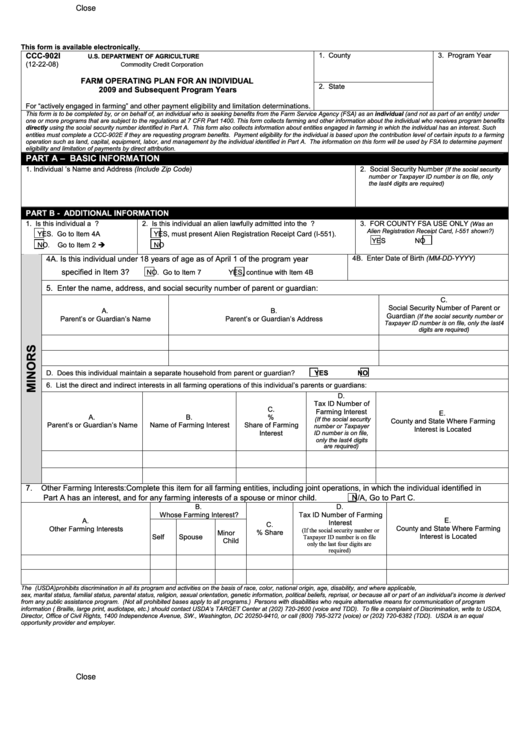

CCC-902I

1. County

3. Program Year

U.S. DEPARTMENT OF AGRICULTURE

(12-22-08)

Commodity Credit Corporation

FARM OPERATING PLAN FOR AN INDIVIDUAL

2. State

2009 and Subsequent Program Years

For “actively engaged in farming” and other payment eligibility and limitation determinations.

This form is to be completed by, or on behalf of, an individual who is seeking benefits from the Farm Service Agency (FSA) as an individual (and not as part of an entity) under

one or more programs that are subject to the regulations at 7 CFR Part 1400. This form collects farming and other information about the individual who receives program benefits

directly using the social security number identified in Part A. This form also collects information about entities engaged in farming in which the individual has an interest. Such

entities must complete a CCC-902E if they are requesting program benefits. Payment eligibility for the individual is based upon the contribution level of certain inputs to a farming

operation such as land, capital, equipment, labor, and management by the individual identified in Part A. The information on this form will be used by FSA to determine payment

eligibility and limitation of payments by direct attribution.

PART A – BASIC INFORMATION

1. Individual ’s Name and Address (Include Zip Code)

2. Social Security Number

(If the social security

number or Taxpayer ID number is on file, only

the last4 digits are required)

PART B - ADDITIONAL INFORMATION

1. Is this individual a U.S. citizen?

2. Is this individual an alien lawfully admitted into the U.S.?

3. FOR COUNTY FSA USE ONLY

(Was an

Alien Registration Receipt Card, I-551 shown?)

YES. Go to Item 4A

YES, must present Alien Registration Receipt Card (I-551).

YES

NO

NO.

Go to Item 2

NO

4B. Enter Date of Birth (MM-DD-YYYY)

4A. Is this individual under 18 years of age as of April 1 of the program year

specified in Item 3?

NO. Go to Item 7

YES, continue with Item 4B

5. Enter the name, address, and social security number of parent or guardian:

C.

Social Security Number of Parent or

A.

B.

Guardian

(If the social security number or

Parent’s or Guardian’s Name

Parent’s or Guardian’s Address

Taxpayer ID number is on file, only the last4

digits are required)

D. Does this individual maintain a separate household from parent or guardian?

YES

NO

6. List the direct and indirect interests in all farming operations of this individual’s parents or guardians:

D.

Tax ID Number of

C.

Farming Interest

E.

A.

B.

%

(If the social security

County and State Where Farming

Parent’s or Guardian’s Name

Name of Farming Interest

Share of Farming

number or Taxpayer

Interest is Located

Interest

ID number is on file,

only the last4 digits

are required)

7.

Other Farming Interests: Complete this item for all farming entities, including joint operations, in which the individual identified in

Part A has an interest, and for any farming interests of a spouse or minor child.

N/A, Go to Part C.

B.

D.

Whose Farming Interest?

Tax ID Number of Farming

E.

A.

Interest

C.

Other Farming Interests

County and State Where Farming

(If the social security number or

Minor

% Share

Interest is Located

Self

Spouse

Taxpayer ID number is on file

Child

only the last four digits are

required)

The U.S. Department of Agriculture (USDA) prohibits discrimination in all its program and activities on the basis of race, color, national origin, age, disability, and where applicable,

sex, marital status, familial status, parental status, religion, sexual orientation, genetic information, political beliefs, reprisal, or because all or part of an individual’s income is derived

from any public assistance program. (Not all prohibited bases apply to all programs.) Persons with disabilities who require alternative means for communication of program

information ( Braille, large print, audiotape, etc.) should contact USDA’s TARGET Center at (202) 720-2600 (voice and TDD). To file a complaint of Discrimination, write to USDA,

Director, Office of Civil Rights, 1400 Independence Avenue, SW., Washington, DC 20250-9410, or call (800) 795-3272 (voice) or (202) 720-6382 (TDD). USDA is an equal

opportunity provider and employer.

Close

1

1 2

2 3

3 4

4