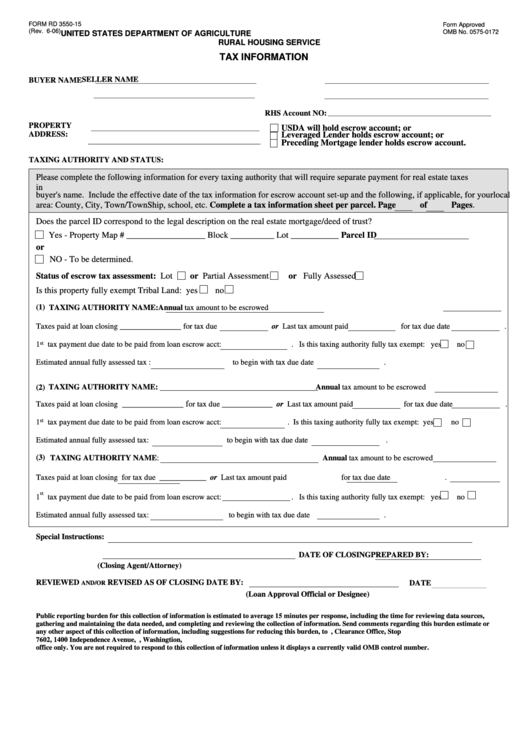

FORM RD 3550-15

Form Approved

(Rev. 6-06)

OMB No. 0575-0172

UNITED STATES DEPARTMENT OF AGRICULTURE

RURAL HOUSING SERVICE

TAX INFORMATION

SELLER NAME

BUYER NAME

RHS Account NO:

PROPERTY

USDA will hold escrow account; or

ADDRESS:

Leveraged Lender holds escrow account; or

Preceding Mortgage lender holds escrow account.

TAXING AUTHORITY AND STATUS:

Please complete the following information for every taxing authority that will require separate payment for real estate taxes

in

buyer's name. Include the effective date of the tax information for escrow account set-up and the following, if applicable, for your local

area: County, City, Town/TownShip, school, etc. Complete a tax information sheet per parcel. Page

of

Pages.

Does the parcel ID correspond to the legal description on the real estate mortgage/deed of trust?

Yes - Property Map # __________________ Block __________ Lot ___________ Parcel ID

or

NO - To be determined.

Status of escrow tax assessment: Lot

or Partial Assessment

or Fully Assessed

Is this property fully exempt Tribal Land: yes

no

(1) TAXING AUTHORITY NAME:

Annual tax amount to be escrowed

______________

Taxes paid at loan closing

for tax due

or Last tax amount paid

for tax due date

.

1 tax payment due date to be paid from loan escrow acct:

st

. Is this taxing authority fully tax exempt: yes

no

Estimated annual fully assessed tax :

to begin with tax due date

.

(2)

TAXING AUTHORITY NAME:

Annual tax amount to be escrowed

______________ f

Taxes paid at loan closing

or tax due _____________ or Last tax amount paid

for tax due date

.

st

1 tax payment due date to be paid from loan escrow acct:

. Is this taxing authority fully tax exempt: yes

no

Estimated annual fully assessed tax:

to begin with tax due date

.

(3)

TAXING AUTHORITY NAME:

Annual tax amount to be escrowed

Taxes paid at loan closing

for tax due ____________ or Last tax amount paid

for tax due date

.

st

1 tax payment due date to be paid from loan escrow acct:

. Is this taxing authority fully tax exempt: yes

no

Estimated annual fully assessed tax:

to begin with tax due date

.

Special Instructions:

PREPARED BY:

DATE OF CLOSING

(Closing Agent/Attorney)

REVIEWED

REVISED AS OF CLOSING DATE BY:

DATE

AND/OR

(Loan Approval Official or Designee)

Public reporting burden for this collection of information is estimated to average 15 minutes per response, including the time for reviewing data sources,

gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or

any other aspect of this collection of information, including suggestions for reducing this burden, to U.S. Department of Agriculture, Clearance Office, Stop

7602, 1400 Independence Avenue, S.W., Washingtion, D.C. 20250-7602. Please DO NOT RETURN this form to this address. Forward to the local USDA

office only. You are not required to respond to this collection of information unless it displays a currently valid OMB control number.

1

1