Schedule Of Rates & Taxes

ADVERTISEMENT

K

>

^

^

^

K

&

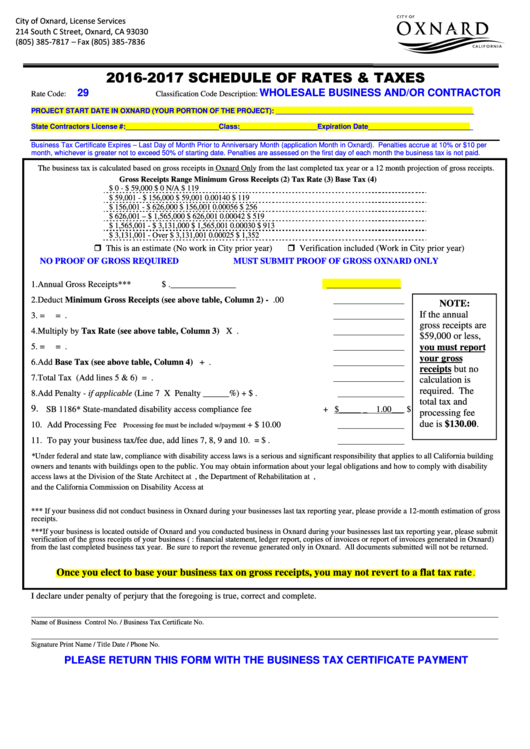

2016-2017 SCHEDULE OF RATES & TAXES

29

WHOLESALE BUSINESS AND/OR CONTRACTOR

Rate Code:

Classification Code Description:

PROJECT START DATE IN OXNARD (YOUR PORTION OF THE PROJECT): ___________________________________________________

State Contractors License #:________________________Class:____________________Expiration Date___________________________

Business Tax Certificate Expires – Last Day of Month Prior to Anniversary Month (application Month in Oxnard). Penalties accrue at 10% or $10 per

month, whichever is greater not to exceed 50% of starting date. Penalties are assessed on the first day of each month the business tax is not paid.

The business tax is calculated based on gross receipts in Oxnard Only from the last completed tax year or a 12 month projection of gross receipts.

Gross Receipts Range

Minimum Gross Receipts (2)

Tax Rate (3)

Base Tax (4)

$

0 - $

59,000

$

0

N/A

$

119

$

59,001 - $

156,000

$

59,001

0.00140

$

119

$

156,001 - $

626,000

$

156,001

0.00056

$

256

$

626,001 – $ 1,565,000

$

626,001

0.00042

$

519

$ 1,565,001 - $

3,131,000

$ 1,565,001

0.00030

$

913

$ 3,131,001 - Over

$ 3,131,001

0.00025

$ 1,352

This is an estimate (No work in City prior year)

Verification included (Work in City prior year)

NO PROOF OF GROSS REQUIRED

MUST SUBMIT PROOF OF GROSS OXNARD ONLY

1.

Annual Gross Receipts***

$ ._______________

2.

Deduct Minimum Gross Receipts (see above table, Column 2)

-

.00

NOTE:

If the annual

3.

=

=

.

gross receipts are

4.

Multiply by Tax Rate (see above table, Column 3)

X

.

$59,000 or less,

5.

=

=

.

you must report

your gross

6.

Add Base Tax (see above table, Column 4)

+

.

receipts but no

7.

Total Tax

(Add lines 5 & 6)

=

.

calculation is

required. The

8.

Add Penalty - if applicable

(Line 7 X Penalty ______%)

+ $

.

total tax and

9.

SB 1186* State-mandated disability access compliance fee

+ $_____ _ 1.00___

$

processing fee

due is $130.00.

10. Add Processing Fee

+ $

10.00

Processing fee must be included w/payment

11. To pay your business tax/fee due, add lines 7, 8, 9 and 10.

= $

.

*Under federal and state law, compliance with disability access laws is a serious and significant responsibility that applies to all California building

owners and tenants with buildings open to the public. You may obtain information about your legal obligations and how to comply with disability

access laws at the Division of the State Architect at , the Department of Rehabilitation at ,

and the California Commission on Disability Access at

*** If your business did not conduct business in Oxnard during your businesses last tax reporting year, please provide a 12-month estimation of gross

receipts.

***If your business is located outside of Oxnard and you conducted business in Oxnard during your businesses last tax reporting year, please submit

verification of the gross receipts of your business (i.e.: financial statement, ledger report, copies of invoices or report of invoices generated in Oxnard)

from the last completed business tax year. Be sure to report the revenue generated only in Oxnard. All documents submitted will not be returned.

Once you elect to base your business tax on gross receipts, you may not revert to a flat tax rate

.

I declare under penalty of perjury that the foregoing is true, correct and complete.

Name of Business

Control No. / Business Tax Certificate No.

Signature

Print Name / Title

Date / Phone No.

PLEASE RETURN THIS FORM WITH THE BUSINESS TAX CERTIFICATE PAYMENT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2