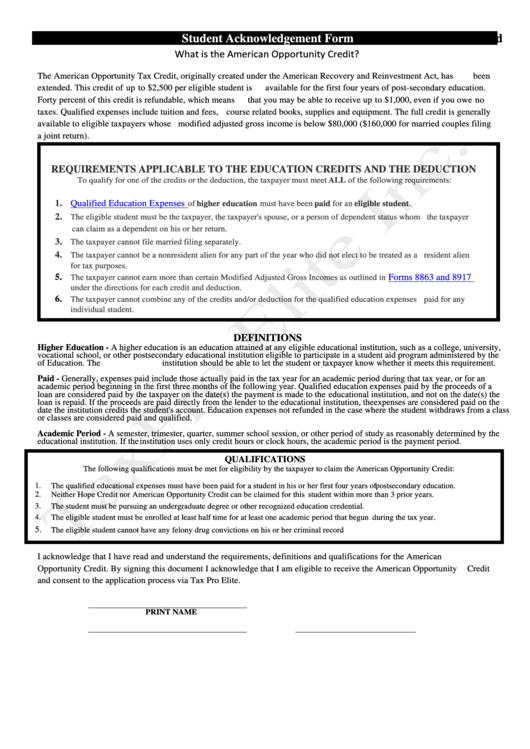

Student Acknowledgement Form

ADVERTISEMENT

ddddddddddddddddddddddStudent Acknowledgement Form

ddddddddddddddddddddd

What is the American Opportunity Credit?

The American Opportunity Tax Credit, originally created under the American Recovery and Reinvestment Act, has been

extended. This credit of up to $2,500 per eligible student is available for the first four years of post-secondary education.

Forty percent of this credit is refundable, which means that you may be able to receive up to $1,000, even if you owe no

taxes. Qualified expenses include tuition and fees, course related books, supplies and equipment. The full credit is generally

available to eligible taxpayers whose modified adjusted gross income is below $80,000 ($160,000 for married couples filing

a joint return).

REQUIREMENTS APPLICABLE TO THE EDUCATION CREDITS AND THE DEDUCTION

To qualify for one of the credits or the deduction, the taxpayer must meet ALL of the following requirements:

1.

Qualified Education Expenses

of higher education must have been paid for an eligible student.

2.

The eligible student must be the taxpayer, the taxpayer's spouse, or a person of dependent status whom the taxpayer

can claim as a dependent on his or her return.

3.

The taxpayer cannot file married filing separately.

4.

The taxpayer cannot be a nonresident alien for any part of the year who did not elect to be treated as a resident alien

for tax purposes.

5.

Forms 8863 and 8917

The taxpayer cannot earn more than certain Modified Adjusted Gross Incomes as outlined in

under the directions for each credit and deduction.

6.

The taxpayer cannot combine any of the credits and/or deduction for the qualified education expenses paid for any

individual student.

DEFINITIONS

Higher Education - A higher education is an education attained at any eligible educational institution, such as a college, university,

vocational school, or other postsecondary educational institution eligible to participate in a student aid program administered by the

U.S. Department of Education. The institution should be able to let the student or taxpayer know whether it meets this requirement.

Paid - Generally, expenses paid include those actually paid in the tax year for an academic period during that tax year, or for an

academic period beginning in the first three months of the following year. Qualified education expenses paid by the proceeds of a

loan are considered paid by the taxpayer on the date(s) the payment is made to the educational institution, and not on the date(s) the

loan is repaid. If the proceeds are paid directly from the lender to the educational institution, the expenses are considered paid on the

date the institution credits the student's account. Education expenses not refunded in the case where the student withdraws from a class

or classes are considered paid and qualified.

Academic Period - A semester, trimester, quarter, summer school session, or other period of study as reasonably determined by the

educational institution. If the institution uses only credit hours or clock hours, the academic period is the payment period.

QUALIFICATIONS

The following qualifications must be met for eligibility by the taxpayer to claim the American Opportunity Credit:

1.

The qualified educational expenses must have been paid for a student in his or her first four years of postsecondary education.

2.

Neither Hope Credit nor American Opportunity Credit can be claimed for this student within more than 3 prior years.

3.

The student must be pursuing an undergraduate degree or other recognized education credential.

4.

The eligible student must be enrolled at least half time for at least one academic period that begun during the tax year.

5.

.

The eligible student cannot have any felony drug convictions on his or her criminal record

I acknowledge that I have read and understand the requirements, definitions and qualifications for the American

Opportunity Credit. By signing this document I acknowledge that I am eligible to receive the American Opportunity Credit

and consent to the application process via Tax Pro Elite.

PRINT NAME

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2