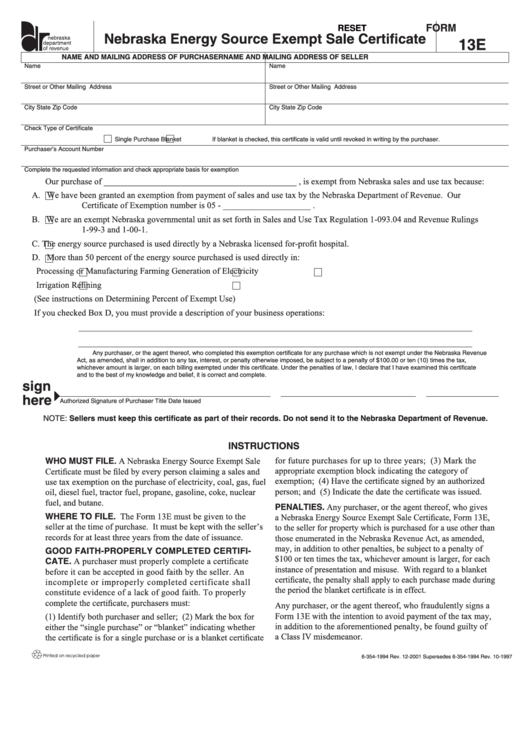

FORM

RESET

Nebraska Energy Source Exempt Sale Certificate

13E

NAME AND MAILING ADDRESS OF PURCHASER

NAME AND MAILING ADDRESS OF SELLER

Name

Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

Check Type of Certificate

Single Purchase

Blanket

If blanket is checked, this certificate is valid until revoked in writing by the purchaser.

Purchaser’s Account Number

Complete the requested information and check appropriate basis for exemption

Our purchase of ____________________________________________ , is exempt from Nebraska sales and use tax because:

A. We have been granted an exemption from payment of sales and use tax by the Nebraska Department of Revenue. Our

Certificate of Exemption number is 05 - ____________________ .

B. We are an exempt Nebraska governmental unit as set forth in Sales and Use Tax Regulation 1-093.04 and Revenue Rulings

1-99-3 and 1-00-1.

C. The energy source purchased is used directly by a Nebraska licensed for-profit hospital.

D. More than 50 percent of the energy source purchased is used directly in:

Processing or Manufacturing

Farming

Generation of Electricity

Irrigation

Refining

(See instructions on Determining Percent of Exempt Use)

If you checked Box D, you must provide a description of your business operations:

Any purchaser, or the agent thereof, who completed this exemption certificate for any purchase which is not exempt under the Nebraska Revenue

Act, as amended, shall in addition to any tax, interest, or penalty otherwise imposed, be subject to a penalty of $100.00 or ten (10) times the tax,

whichever amount is larger, on each billing exempted under this certificate. Under the penalties of law, I declare that I have examined this certificate

and to the best of my knowledge and belief, it is correct and complete.

sign

here

Authorized Signature of Purchaser

Title

Date Issued

NOTE: Sellers must keep this certificate as part of their records. Do not send it to the Nebraska Department of Revenue.

INSTRUCTIONS

for future purchases for up to three years; (3) Mark the

WHO MUST FILE. A Nebraska Energy Source Exempt Sale

appropriate exemption block indicating the category of

Certificate must be filed by every person claiming a sales and

exemption; (4) Have the certificate signed by an authorized

use tax exemption on the purchase of electricity, coal, gas, fuel

person; and (5) Indicate the date the certificate was issued.

oil, diesel fuel, tractor fuel, propane, gasoline, coke, nuclear

fuel, and butane.

PENALTIES. Any purchaser, or the agent thereof, who gives

WHERE TO FILE. The Form 13E must be given to the

a Nebraska Energy Source Exempt Sale Certificate, Form 13E,

seller at the time of purchase. It must be kept with the seller’s

to the seller for property which is purchased for a use other than

records for at least three years from the date of issuance.

those enumerated in the Nebraska Revenue Act, as amended,

may, in addition to other penalties, be subject to a penalty of

GOOD FAITH-PROPERLY COMPLETED CERTIFI-

$100 or ten times the tax, whichever amount is larger, for each

CATE. A purchaser must properly complete a certificate

instance of presentation and misuse. With regard to a blanket

before it can be accepted in good faith by the seller. An

certificate, the penalty shall apply to each purchase made during

incomplete or improperly completed certificate shall

the period the blanket certificate is in effect.

constitute evidence of a lack of good faith. To properly

complete the certificate, purchasers must:

Any purchaser, or the agent thereof, who fraudulently signs a

Form 13E with the intention to avoid payment of the tax may,

(1) Identify both purchaser and seller; (2) Mark the box for

in addition to the aforementioned penalty, be found guilty of

either the “single purchase” or “blanket” indicating whether

a Class IV misdemeanor.

the certificate is for a single purchase or is a blanket certificate

6-354-1994 Rev. 12-2001 Supersedes 6-354-1994 Rev. 10-1997

1

1 2

2