Sales And Use Tax Return Form - South Dakota

ADVERTISEMENT

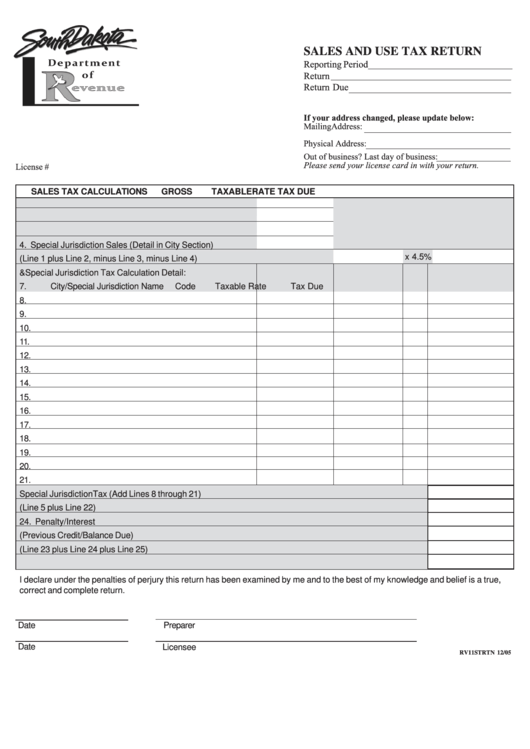

SALES AND USE TAX RETURN

Reporting Period

Return

Return Due

If your address changed, please update below:

Mailing Address:

Physical Address:

Out of business? Last day of business:

Please send your license card in with your return.

License #

SALES TAX CALCULATIONS

GROSS

TAXABLE

RATE

TAX DUE

1. Gross Sales

2. Use Taxable

3. Non-Taxable Sales

4. Special Jurisdiction Sales (Detail in City Section)

x 4.5%

5. Net State Sales Taxable (Line 1 plus Line 2, minus Line 3, minus Line 4)

6. City & Special Jurisdiction Tax Calculation Detail:

7.

City/Special Jurisdiction Name

Code

Taxable

Rate

Tax Due

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22. Total City/Special Jurisdiction Tax (Add Lines 8 through 21)

23. Total Tax Due (Line 5 plus Line 22)

24. Penalty/Interest

25. Adjustment (Previous Credit/Balance Due)

26. Total Due (Line 23 plus Line 24 plus Line 25)

27. Amount Remitted

I declare under the penalties of perjury this return has been examined by me and to the best of my knowledge and belief is a true,

correct and complete return.

Date

Preparer

Date

Licensee

RV11STRTN 12/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2