Payroll Processor'S Disclosure Form

ADVERTISEMENT

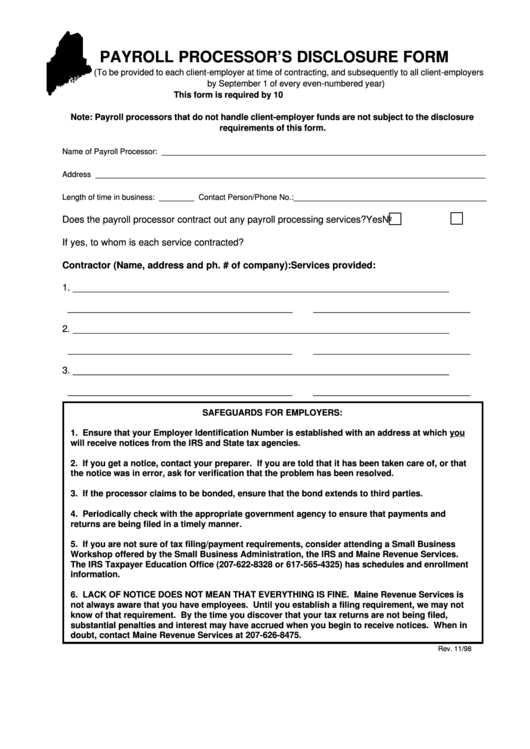

PAYROLL PROCESSOR’S DISCLOSURE FORM

(To be provided to each client-employer at time of contracting, and subsequently to all client-employers

by September 1 of every even-numbered year)

This form is required by 10 M.R.S.A. Chapter 222

Note: Payroll processors that do not handle client-employer funds are not subject to the disclosure

requirements of this form.

Name of Payroll Processor: __________________________________________________________________________

Address _________________________________________________________________________________________

Length of time in business: ________ Contact Person/Phone No.:____________________________________________

Does the payroll processor contract out any payroll processing services?

Yes

No

If yes, to whom is each service contracted?

Contractor (Name, address and ph. # of company):

Services provided:

1. __________________________________________

______________________________

___________________________________________

______________________________

2. __________________________________________

______________________________

___________________________________________

______________________________

3. __________________________________________

______________________________

___________________________________________

______________________________

SAFEGUARDS FOR EMPLOYERS:

1. Ensure that your Employer Identification Number is established with an address at which you

will receive notices from the IRS and State tax agencies.

2. If you get a notice, contact your preparer. If you are told that it has been taken care of, or that

the notice was in error, ask for verification that the problem has been resolved.

3. If the processor claims to be bonded, ensure that the bond extends to third parties.

4. Periodically check with the appropriate government agency to ensure that payments and

returns are being filed in a timely manner.

5. If you are not sure of tax filing/payment requirements, consider attending a Small Business

Workshop offered by the Small Business Administration, the IRS and Maine Revenue Services.

The IRS Taxpayer Education Office (207-622-8328 or 617-565-4325) has schedules and enrollment

information.

6. LACK OF NOTICE DOES NOT MEAN THAT EVERYTHING IS FINE. Maine Revenue Services is

not always aware that you have employees. Until you establish a filing requirement, we may not

know of that requirement. By the time you discover that your tax returns are not being filed,

substantial penalties and interest may have accrued when you begin to receive notices. When in

doubt, contact Maine Revenue Services at 207-626-8475.

Rev. 11/98

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1