Reset Form

Print and Reset Form

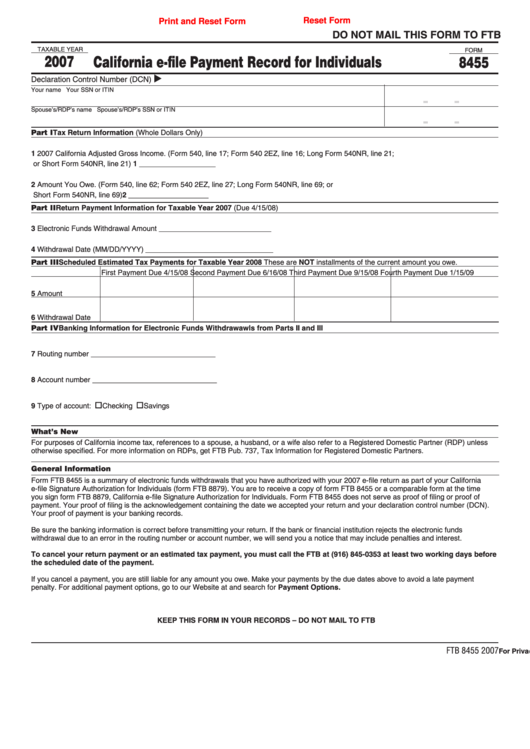

Do NoT MAIL THIS FoRM To FTB

TAXABLE YEAR

FORM

2007

California e-file Payment Record for Individuals

8455

Declaration Control Number (DCN)

Your name

Your SSN or ITIN

-

-

Spouse’s/RDP’s name

Spouse’s/RDP’s SSN or ITIN

-

-

Part I Tax Return Information (Whole Dollars Only)

1 2007 California Adjusted Gross Income. (Form 540, line 17; Form 540 2EZ, line 16; Long Form 540NR, line 21;

or Short Form 540NR, line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1 ___________________

2 Amount You Owe. (Form 540, line 62; Form 540 2EZ, line 27; Long Form 540NR, line 69; or

Short Form 540NR, line 69) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2 ______________________

Part II Return Payment Information for Taxable Year 2007 (Due 4/15/08)

3 Electronic Funds Withdrawal Amount ____________________________

4 Withdrawal Date (MM/DD/YYYY) ___________________________________

Part III Scheduled Estimated Tax Payments for Taxable Year 2008 These are NoT installments of the current amount you owe.

First Payment Due 4/15/08 Second Payment Due 6/16/08 Third Payment Due 9/15/08 Fourth Payment Due 1/15/09

5 Amount

6 Withdrawal Date

Part IV Banking Information for Electronic Funds Withdrawawls from Parts II and III

7 Routing number _______________________________

8 Account number _______________________________

9 Type of account:

Checking

Savings

What’s New

For purposes of California income tax, references to a spouse, a husband, or a wife also refer to a Registered Domestic Partner (RDP) unless

otherwise specified. For more information on RDPs, get FTB Pub. 737, Tax Information for Registered Domestic Partners.

General Information

Form FTB 8455 is a summary of electronic funds withdrawals that you have authorized with your 2007 e-file return as part of your California

e-file Signature Authorization for Individuals (form FTB 8879). You are to receive a copy of form FTB 8455 or a comparable form at the time

you sign form FTB 8879, California e-file Signature Authorization for Individuals. Form FTB 8455 does not serve as proof of filing or proof of

payment. Your proof of filing is the acknowledgement containing the date we accepted your return and your declaration control number (DCN).

Your proof of payment is your banking records.

Be sure the banking information is correct before transmitting your return. If the bank or financial institution rejects the electronic funds

withdrawal due to an error in the routing number or account number, we will send you a notice that may include penalties and interest.

To cancel your return payment or an estimated tax payment, you must call the FTB at (916) 845-0353 at least two working days before

the scheduled date of the payment.

If you cancel a payment, you are still liable for any amount you owe. Make your payments by the due dates above to avoid a late payment

penalty. For additional payment options, go to our Website at and search for Payment options.

KEEP THIS FoRM IN YoUR RECoRDS – Do NoT MAIL To FTB

FTB 8455 2007

For Privacy Notice, get form FTB 1131.

1

1