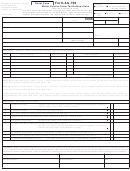

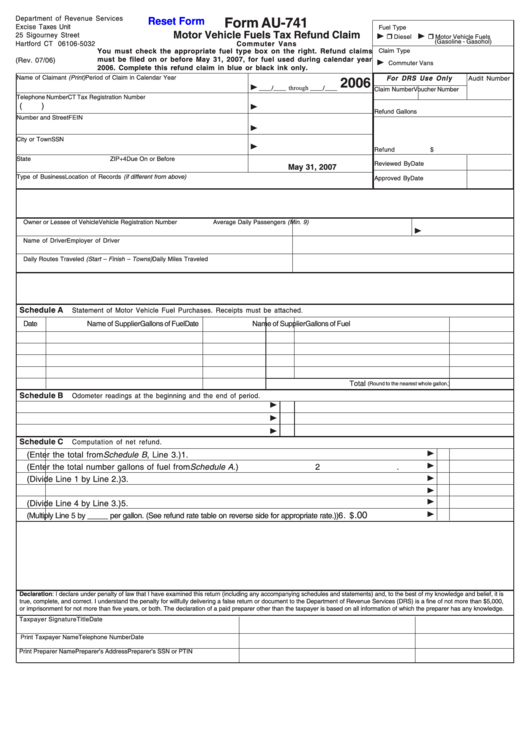

Department of Revenue Services

Form AU-741

Reset Form

Excise Taxes Unit

Fuel Type

Motor Vehicle Fuels Tax Refund Claim

25 Sigourney Street

Diesel

Motor Vehicle Fuels

(Gasoline - Gasohol)

Hartford CT 06106-5032

Commuter Vans

You must check the appropriate fuel type box on the right. Refund claims

Claim Type

must be filed on or before May 31, 2007, for fuel used during calendar year

(Rev. 07/06)

Commuter Vans

2006. Complete this refund claim in blue or black ink only.

Name of Claimant (Print)

Period of Claim in Calendar Year

For DRS Use Only

Audit Number

2006

____/____ through ____/____

Claim Number

Voucher Number

Telephone Number

CT Tax Registration Number

(

)

Refund Gallons

Number and Street

FEIN

City or Town

SSN

Refund

$

State

ZIP+4

Due On or Before

Reviewed By

Date

May 31, 2007

Type of Business

Location of Records (if different from above)

Approved By

Date

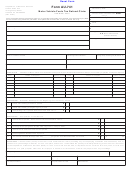

Owner or Lessee of Vehicle

Vehicle Registration Number

Average Daily Passengers (Min. 9)

Name of Driver

Employer of Driver

Daily Routes Traveled (Start – Finish – Towns)

Daily Miles Traveled

Schedule A

Statement of Motor Vehicle Fuel Purchases. Receipts must be attached.

Date

Name of Supplier

Gallons of Fuel

Date

Name of Supplier

Gallons of Fuel

Total

(Round to the nearest whole gallon.)

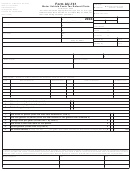

Schedule B

Odometer readings at the beginning and the end of period.

1.

Odometer reading at end of a period.

1.

2.

Odometer reading at beginning of a period.

2.

3.

Total mileage for a period.

3.

Schedule C

Computation of net refund.

1.

Total miles for period (Enter the total from Schedule B, Line 3.)

1.

2.

Total fuel gallons for period (Enter the total number gallons of fuel from Schedule A.)

2.

3.

Average miles per gallon (Divide Line 1 by Line 2.)

3.

4.

Total miles to and from work for this period

4.

5.

Refund gallons (Divide Line 4 by Line 3.)

5.

.00

6.

Tax refund claimed

(Multiply Line 5 by _____ per gallon. (See refund rate table on reverse side for appropriate rate.))

6. $

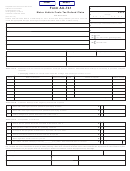

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is

true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of Revenue Services (DRS) is a fine of not more than $5,000,

or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer Signature

Title

Date

Print Taxpayer Name

Telephone Number

Date

Print Preparer Name

Preparer’s Address

Preparer’s SSN or PTIN

1

1