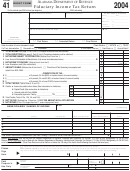

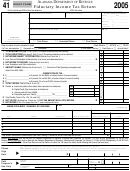

FORM 41 – 2005

PAGE 2

PART I – Income

DIVIDEND INCOME (List Payers and Amounts)

1 Total Income from Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

INTEREST INCOME (List Payers and Amounts)

EXEMPT

TAXABLE

2 Total Taxable Income from Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

PROFIT FROM SALE OF REAL ESTATE, STOCKS, BONDS, ETC.

Depreciation

3

4

5

6

7

8

Date

Amount

Cost or

Subsequent

Kind of Property

Allowable Since

Acquired

Received

Other Basis

Improvements

Acquisition

9 Totals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 Net Profit or (Loss) (Sum of columns 5 and 6, less columns 7 and 8). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

INCOME FROM RENTS AND ROYALTIES

11

12

13

Depreciation

14

15

Other

Amount of

Repairs

Kind and Location of Property

or Depletion

Expenses

Rent or Royalty

(Attach Itemized List)

(Explain in Part II)

(Attach Itemized List)

16 Totals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 Net Profit or (Loss) (Column 12 less sum of columns 13, 14, and 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18 Income from Partnerships (Name and Address)

18

19 Income from Other Fiduciaries (Name and Address)

19

20 Business Income (Attach copy of Federal Schedule C) (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21 Farm Income (Attach copy of Federal Schedule F) (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22 Income from Other Sources (State nature) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23 TOTAL INCOME OR (LOSS) (Add lines 1, 2, 10, 17, 18, 19, 20, 21, and 22)

Enter here and on page 1, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

PART II – Explanation of Deduction For Depreciation Claimed In Part I, Column 13

1

2

3

4

5

6

7

Depreciation

Kind of Property (if buildings, material

Method of

Date

Cost or

Allowed (or

Rate (%)

Depreciation

of which constructed). Exclude land and

Computing

Acquired

Other Basis

Allowable) in

or Life (Years)

for This Year

other nondepreciable property.

Depreciation

Prior Years

PART III – Deductions

Describe deductions and state to whom paid. If more space is needed, list deductions on separate sheet of paper and attach to this return.

INTEREST PAID

CASUALTY AND THEFT LOSSES (Attach Federal Form 4684)

3a Enter the amount from Form 4684 . . . . . . . .

3b Less exclusion: Enter 10% of Form 41, line 1

3c Allowable Loss (Subtract line 3b from 3a)

If zero or less, enter zero . . . . . . . . . . . . . .

OTHER DEDUCTIONS (See instructions) (Attach list)

4a Deductions subject to 2% limitation. . . . . . . .

4b Enter 2% of Form 41, line 1. . . . . . . . . . . . . .

1 Total Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4c Balance (Subtract line 4b from 4a)

TAXES (See instructions)

If zero or less, enter zero. . . . . . . . . . . . . . . .

4d Deductions NOT subject to 2% limitation . . .

4e Total Other Deductions

(Add lines 4c and 4d) . . . . . . . . . . . . . . . . .

5 TOTAL (Add lines 1, 2, 3c, and 4e)

2 Total Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter here and on page 1, line 2 . . . . . . . .

1

1 2

2