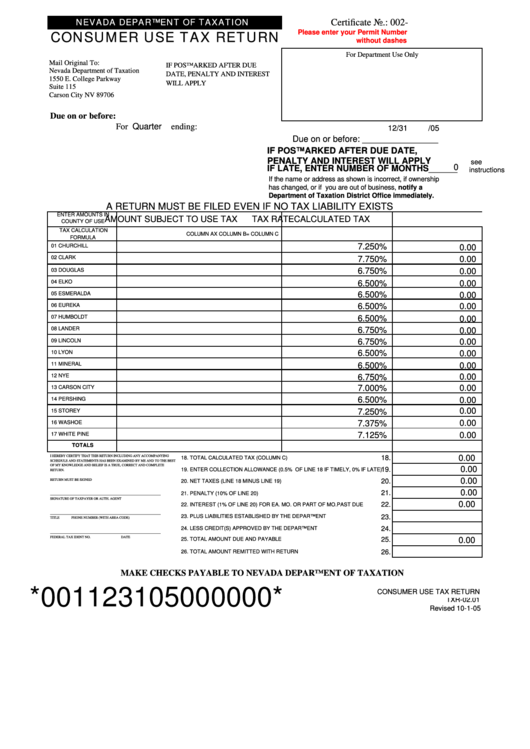

NEVADA DEPARTMENT OF TAXATION

Certificate No.: 002-

CONSUMER USE TAX RETURN

Please enter your Permit Number

without dashes

For Department Use Only

Mail Original To:

IF POSTMARKED AFTER DUE

Nevada Department of Taxation

DATE, PENALTY AND INTEREST

1550 E. College Parkway

WILL APPLY

Suite 115

Carson City NV 89706

Due on or before:

For

Quarter

ending:

12/31

/05

Due on or before: ________________

IF POSTMARKED AFTER DUE DATE,

PENALTY AND INTEREST WILL APPLY

see

0

IF LATE, ENTER NUMBER OF MONTHS______

instructions

If the name or address as shown is incorrect, if ownership

has changed, or if you are out of business, notify a

Department of Taxation District Office immediately.

A RETURN MUST BE FILED EVEN IF NO TAX LIABILITY EXISTS

ENTER AMOUNTS IN

AMOUNT SUBJECT TO USE TAX

TAX RATE

CALCULATED TAX

COUNTY OF USE

TAX CALCULATION

COLUMN A

X COLUMN B

= COLUMN C

FORMULA

7.250%

0.00

01 CHURCHILL

7.750%

0.00

02 CLARK

0.00

03 DOUGLAS

6.750%

04 ELKO

0.00

6.500%

05 ESMERALDA

6.500%

0.00

06 EUREKA

6.500%

0.00

07 HUMBOLDT

6.500%

0.00

08 LANDER

6.750%

0.00

09 LINCOLN

6.750%

0.00

10 LYON

6.500%

0.00

11 MINERAL

6.500%

0.00

12 NYE

0.00

6.750%

7.000%

0.00

13 CARSON CITY

14 PERSHING

6.500%

0.00

0.00

15 STOREY

7.250%

0.00

7.375%

16 WASHOE

17 WHITE PINE

7.125%

0.00

TOTALS

I HEREBY CERTIFY THAT THIS RETURN INCLUDING ANY ACCOMPANYING

0.00

18. TOTAL CALCULATED TAX (COLUMN C)

18.

SCHEDULE AND STATEMENTS HAS BEEN EXAMINED BY ME AND TO THE BEST

OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE

0.00

19. ENTER COLLECTION ALLOWANCE (0.5% OF LINE 18 IF TIMELY, 0% IF LATE)

19.

RETURN.

0.00

RETURN MUST BE SIGNED

20. NET TAXES (LINE 18 MINUS LINE 19)

20.

0.00

21.

21. PENALTY (10% OF LINE 20)

_______________________________________________________________

SIGNATURE OF TAXPAYER OR AUTH. AGENT

0.00

22. INTEREST (1% OF LINE 20) FOR EA. MO. OR PART OF MO.PAST DUE

22.

_______________________________________________________________

23. PLUS LIABILITIES ESTABLISHED BY THE DEPARTMENT

23.

TITLE

PHONE NUMBER (WITH AREA CODE)

24. LESS CREDIT(S) APPROVED BY THE DEPARTMENT

24.

_______________________________________________________________

FEDERAL TAX IDENT NO.

DATE

0.00

25. TOTAL AMOUNT DUE AND PAYABLE

25.

26. TOTAL AMOUNT REMITTED WITH RETURN

26.

MAKE CHECKS PAYABLE TO NEVADA DEPARTMENT OF TAXATION

*001123105000000*

CONSUMER USE TAX RETURN

TXR-02.01

Revised 10-1-05

1

1