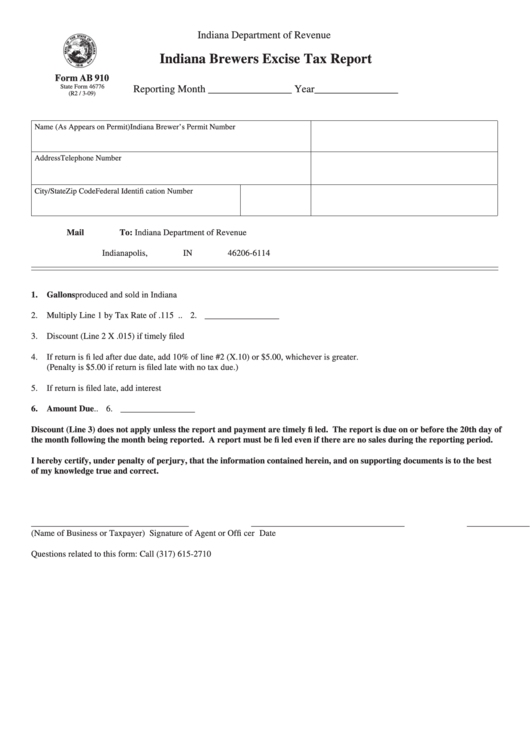

Indiana Department of Revenue

Indiana Brewers Excise Tax Report

Form AB 910

State Form 46776

Reporting Month ________________ Year________________

(R2 / 3-09)

Name (As Appears on Permit)

Indiana Brewer’s Permit Number

Address

Telephone Number

City/State

Zip Code

Federal Identifi cation Number

Mail To: Indiana Department of Revenue

P.O. Box 6114

Indianapolis, IN 46206-6114

1.

Gallons produced and sold in Indiana .......................................................................................... 1. _________________ Gal.

2.

Multiply Line 1 by Tax Rate of .115 ............................................................................................. 2. _________________

3.

Discount (Line 2 X .015) if timely fi led ....................................................................................... 3. _________________

4.

If return is fi led after due date, add 10% of line #2 (X.10) or $5.00, whichever is greater.

(Penalty is $5.00 if return is fi led late with no tax due.) ............................................................... 4. _________________

5.

If return is fi led late, add interest .................................................................................................. 5. _________________

6.

Amount Due ................................................................................................................................ 6. _________________

Discount (Line 3) does not apply unless the report and payment are timely fi led. The report is due on or before the 20th day of

the month following the month being reported. A report must be fi led even if there are no sales during the reporting period.

I hereby certify, under penalty of perjury, that the information contained herein, and on supporting documents is to the best

of my knowledge true and correct.

____________________________________

___________________________________

_________________

(Name of Business or Taxpayer)

Signature of Agent or Offi cer

Date

Questions related to this form: Call (317) 615-2710

1

1