Requirements For Amending The Articles Of Incorporation Of A Nonprofit Corporation, Form Dpr-Am - Articles Of Amendment To The Articles Of Incorporation - Profit Corporation - 2003

ADVERTISEMENT

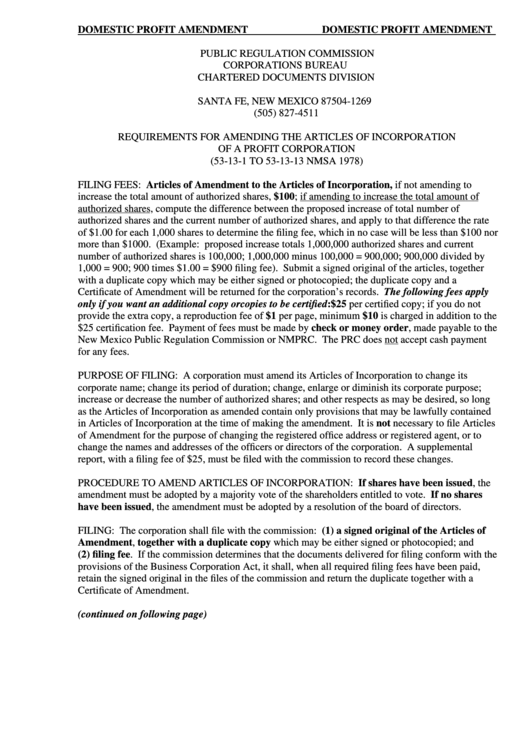

DOMESTIC PROFIT AMENDMENT

DOMESTIC PROFIT AMENDMENT

PUBLIC REGULATION COMMISSION

CORPORATIONS BUREAU

CHARTERED DOCUMENTS DIVISION

P.O. BOX 1269

SANTA FE, NEW MEXICO 87504-1269

(505) 827-4511

REQUIREMENTS FOR AMENDING THE ARTICLES OF INCORPORATION

OF A PROFIT CORPORATION

(53-13-1 TO 53-13-13 NMSA 1978)

FILING FEES: Articles of Amendment to the Articles of Incorporation, if not amending to

increase the total amount of authorized shares, $100; if amending to increase the total amount of

authorized shares, compute the difference between the proposed increase of total number of

authorized shares and the current number of authorized shares, and apply to that difference the rate

of $1.00 for each 1,000 shares to determine the filing fee, which in no case will be less than $100 nor

more than $1000. (Example: proposed increase totals 1,000,000 authorized shares and current

number of authorized shares is 100,000; 1,000,000 minus 100,000 = 900,000; 900,000 divided by

1,000 = 900; 900 times $1.00 = $900 filing fee). Submit a signed original of the articles, together

with a duplicate copy which may be either signed or photocopied; the duplicate copy and a

Certificate of Amendment will be returned for the corporation’s records. The following fees apply

only if you want an additional copy or copies to be certified: $25 per certified copy; if you do not

provide the extra copy, a reproduction fee of $1 per page, minimum $10 is charged in addition to the

$25 certification fee. Payment of fees must be made by check or money order, made payable to the

New Mexico Public Regulation Commission or NMPRC. The PRC does not accept cash payment

for any fees.

PURPOSE OF FILING: A corporation must amend its Articles of Incorporation to change its

corporate name; change its period of duration; change, enlarge or diminish its corporate purpose;

increase or decrease the number of authorized shares; and other respects as may be desired, so long

as the Articles of Incorporation as amended contain only provisions that may be lawfully contained

in Articles of Incorporation at the time of making the amendment. It is not necessary to file Articles

of Amendment for the purpose of changing the registered office address or registered agent, or to

change the names and addresses of the officers or directors of the corporation. A supplemental

report, with a filing fee of $25, must be filed with the commission to record these changes.

PROCEDURE TO AMEND ARTICLES OF INCORPORATION: If shares have been issued, the

amendment must be adopted by a majority vote of the shareholders entitled to vote. If no shares

have been issued, the amendment must be adopted by a resolution of the board of directors.

FILING: The corporation shall file with the commission: (1) a signed original of the Articles of

Amendment, together with a duplicate copy which may be either signed or photocopied; and

(2) filing fee. If the commission determines that the documents delivered for filing conform with the

provisions of the Business Corporation Act, it shall, when all required filing fees have been paid,

retain the signed original in the files of the commission and return the duplicate together with a

Certificate of Amendment.

(continued on following page)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5