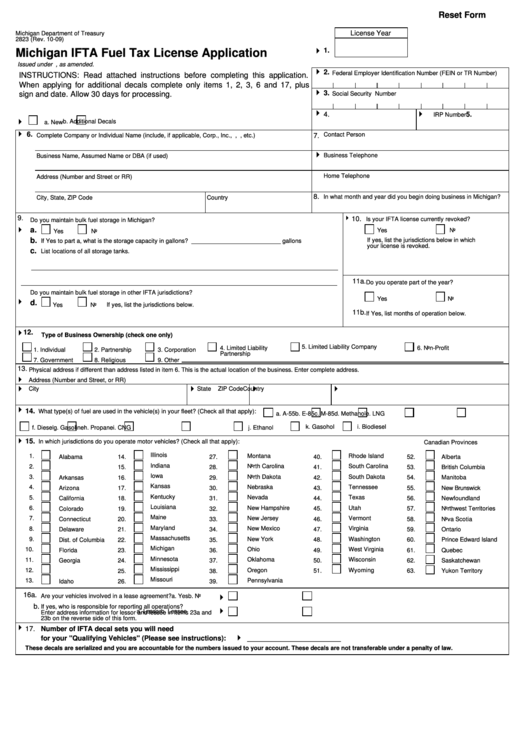

Reset Form

License Year

Michigan Department of Treasury

2823 (Rev. 10-09)

1.

Michigan IFTA Fuel Tax License Application

Issued under P.A. 119 of 1980, as amended.

2.

Federal Employer Identification Number (FEIN or TR Number)

INSTRUCTIONS: Read attached instructions before completing this application.

When applying for additional decals complete only items 1, 2, 3, 6 and 17, plus

3.

sign and date. Allow 30 days for processing.

Social Security Number

4.

5.

U.S. DOT Number

IRP Number

b. Additional Decals

a. New

6.

Contact Person

Complete Company or Individual Name (include, if applicable, Corp., Inc., P.C., L.L.C., etc.)

7.

Business Telephone

Business Name, Assumed Name or DBA (if used)

Home Telephone

Address (Number and Street or RR)

8.

In what month and year did you begin doing business in Michigan?

City, State, ZIP Code

Country

9.

10.

Is your IFTA license currently revoked?

Do you maintain bulk fuel storage in Michigan?

a.

Yes

No

Yes

No

b.

If yes, list the jurisdictions below in which

If Yes to part a, what is the storage capacity in gallons? ___________________________ gallons

your license is revoked.

c.

List locations of all storage tanks.

11a.

Do you operate part of the year?

Do you maintain bulk fuel storage in other IFTA jurisdictions?

Yes

No

d.

Yes

No

If yes, list the jurisdictions below.

11b.

If Yes, list months of operation below.

12.

Type of Business Ownership (check one only)

5. Limited Liability Company

4. Limited Liability

6. Non-Profit

1. Individual

2. Partnership

3. Corporation

Partnership

7. Government

8. Religious

9. Other

13.

Physical address if different than address listed in item 6. This is the actual location of the business. Enter complete address.

Address (Number and Street, or RR)

City

State

ZIP Code

Country

14.

What type(s) of fuel are used in the vehicle(s) in your fleet? (Check all that apply):

a. A-55

b. E-85

c. M-85

d. Methanol

e. LNG

k. Gasohol

i. Biodiesel

f. Diesel

g. Gasoline

h. Propane

i. CNG

j. Ethanol

15.

In which jurisdictions do you operate motor vehicles? (Check all that apply):

Canadian Provinces

Illinois

1.

Montana

Rhode Island

Alabama

14.

27.

40.

52.

Alberta

Indiana

2.

North Carolina

South Carolina

41.

53.

British Columbia

15.

28.

Iowa

3.

North Dakota

South Dakota

Arkansas

16.

29.

42.

54.

Manitoba

Kansas

4.

Nebraska

Tennessee

Arizona

17.

30.

43.

55.

New Brunswick

Kentucky

5.

Nevada

Texas

California

18.

31.

44.

56.

Newfoundland

Louisiana

Utah

6.

New Hampshire

Colorado

19.

32.

45.

57.

Northwest Territories

Maine

7.

New Jersey

Vermont

Connecticut

20.

33.

46.

58.

Nova Scotia

Maryland

8.

New Mexico

Virginia

Delaware

21.

34.

47.

59.

Ontario

Massachusetts

9.

New York

Washington

Dist. of Columbia

22.

35.

48.

60.

Prince Edward Island

Michigan

10.

Ohio

West Virginia

49.

61.

Quebec

Florida

23.

36.

Minnesota

11.

Oklahoma

Wisconsin

Georgia

24.

37.

50.

62.

Saskatchewan

Mississippi

12.

Oregon

Wyoming

25.

38.

51.

63.

Yukon Territory

Missouri

13.

Pennsylvania

Idaho

26.

39.

16a.

Are your vehicles involved in a lease agreement?

a. Yes

b. No

b.

If yes, who is responsible for reporting all operations?

a. Lessor

b. Lessee

Enter address information for lessor and lessee in items 23a and

23b on the reverse side of this form.

17. Number of IFTA decal sets you will need

for your "Qualifying Vehicles" (Please see instructions):

________________________

These decals are serialized and you are accountable for the numbers issued to your account. These decals are not transferable under a penalty of law.

1

1 2

2 3

3 4

4