Clear Form

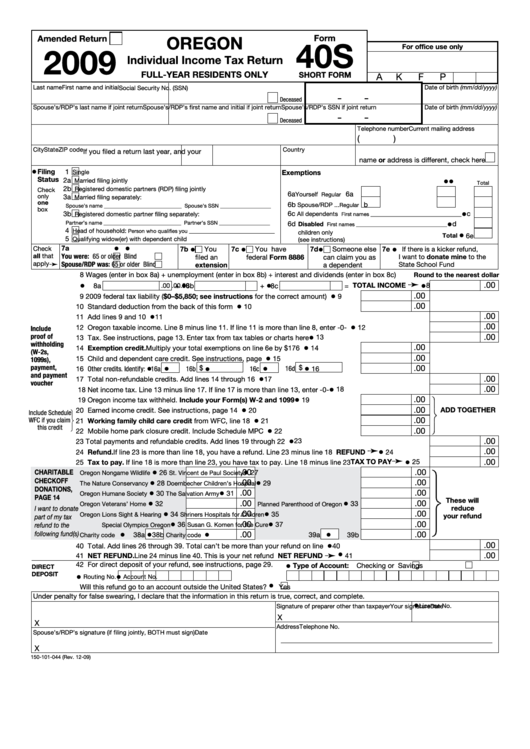

OREGON

Amended Return

Form

40S

2009

For office use only

Individual Income Tax Return

FULL-YEAR RESIDENTS ONLY

SHORT FORM

A

K

F

P

Last name

First name and initial

Date of birth (mm/dd/yyyy)

Social Security No. (SSN)

–

–

Deceased

Spouse’s/RDP’s last name if joint return

Spouse’s/RDP’s first name and initial if joint return Spouse’s/RDP’s SSN if joint return

Date of birth (mm/dd/yyyy)

–

–

Deceased

Current mailing address

Telephone number

(

)

City

State

ZIP code

Country

If you filed a return last year, and your

name or address is different, check here

•

Filing

1

Single

Exemptions

Status

•

•

2a

Married filing jointly

Total

2b

Registered domestic partners (RDP) filing jointly

Check

6a

6a

Yourself ...........

Regular

...... Severely disabled

....

only

3a

Married filing separately:

one

6b

b

Spouse/RDP ...

Regular

...... Severely disabled

......

Spouse’s name _____________________________ Spouse’s SSN ___________________

box

•

3b

Registered domestic partner filing separately:

6c

c

All dependents

First names __________________________________

Partner’s name _____________________________ Partner’s SSN ___________________

•

6d

d

Disabled

First names __________________________________

4

Head of household:

Person who qualifies you ________________________________

children only

•

Total

6e

5

Qualifying widow(er) with dependent child

(see instructions)

•

•

•

•

•

•

Check

7a

7b

You

7c

You have

7d

Someone else

7e

If there is a kicker refund,

all that

You were:

65 or older

Blind

filed an

federal Form 8886

can claim you as

I want to donate mine to the

apply

➛

Spouse/RDP was:

65 or older

Blind

extension

a dependent

State School Fund

8 Wages (enter in box 8a) + unemployment (enter in box 8b) + interest and dividends (enter in box 8c)

Round to the nearest dollar

➛

•

•

•

•

.00

= TOTAL INCOME

8

8a

.00

+

8b

.00

+

8c

.00

•

.00

9 2009 federal tax liability ($0–$5,850; see instructions for the correct amount) .......

9

•

.00

10 Standard deduction from the back of this form .........................................................

10

•

.00

11 Add lines 9 and 10 .........................................................................................................................................

11

•

.00

12 Oregon taxable income. Line 8 minus line 11. If line 11 is more than line 8, enter -0- ..................................

12

Include

•

proof of

.00

13 Tax. See instructions, page 13. Enter tax from tax tables or charts here ......................................................

13

withholding

•

.00

14 Exemption credit. Multiply your total exemptions on line 6e by $176 .....................

14

(W-2s,

•

.00

15 Child and dependent care credit. See instructions, page 13.....................................

15

1099s),

•

payment,

•

•

•

•

.00

16b $

16d $

16 Other credits. Identify:

16a

16c

16

and payment

•

.00

17 Total non-refundable credits. Add lines 14 through 16 .................................................................................

17

voucher

•

.00

18 Net income tax. Line 13 minus line 17. If line 17 is more than line 13, enter -0- ...........................................

18

•

.00

19 Oregon income tax withheld. Include your Form(s) W-2 and 1099 ........................

19

•

.00

ADD TOGETHER

20 Earned income credit. See instructions, page 14 ......................................................

20

Include Schedule

•

.00

WFC if you claim

21 Working family child care credit from WFC, line 18 ...............................................

21

this credit

•

.00

22 Mobile home park closure credit. Include Schedule MPC .........................................

22

•

.00

23

23 Total payments and refundable credits. Add lines 19 through 22 .................................................................

➛

•

.00

24 Refund. If line 23 is more than line 18, you have a refund. Line 23 minus line 18 ................. REFUND

24

➛

•

.00

25 Tax to pay. If line 18 is more than line 23, you have tax to pay. Line 18 minus line 23 .... TAX TO PAY

25

•

•

.00

.00

CHARITAbLE

26

27

Oregon Nongame Wildlife

St. Vincent de Paul Society

CHECkOFF

•

•

.00

.00

28

29

The Nature Conservancy

Doernbecher Children’s Hospital

DONATIONS,

•

•

.00

.00

30

31

Oregon Humane Society

The Salvation Army

PAGE 14

These will

•

•

.00

.00

32

33

Oregon Veterans’ Home

Planned Parenthood of Oregon

reduce

I want to donate

•

•

.00

.00

34

35

Oregon Lions Sight & Hearing

Shriners Hospitals for Children

your refund

part of my tax

•

•

.00

.00

36

37

refund to the

Special Olympics Oregon

Susan G. Komen for the Cure

•

•

•

•

following fund(s)

.00

.00

38a

38b

39a

39b

Charity code

Charity code

•

.00

40 Total. Add lines 26 through 39. Total can’t be more than your refund on line 24..........................................

40

•

➛

.00

41 NET REFUND. Line 24 minus line 40. This is your net refund ....................................... NET REFUND

41

42 For direct deposit of your refund, see instructions, page 29.

•

Type of Account:

Checking or

Savings

DIRECT

DEPOSIT

•

•

Routing No.

Account No.

•

Will this refund go to an account outside the United States?

Yes

Under penalty for false swearing, I declare that the information in this return is true, correct, and complete.

•

License No.

Your signature

Date

Signature of preparer other than taxpayer

X

X

Address

Telephone No.

Spouse’s/RDP’s signature (if filing jointly, BOTH must sign)

Date

X

150-101-044 (Rev. 12-09)

1

1