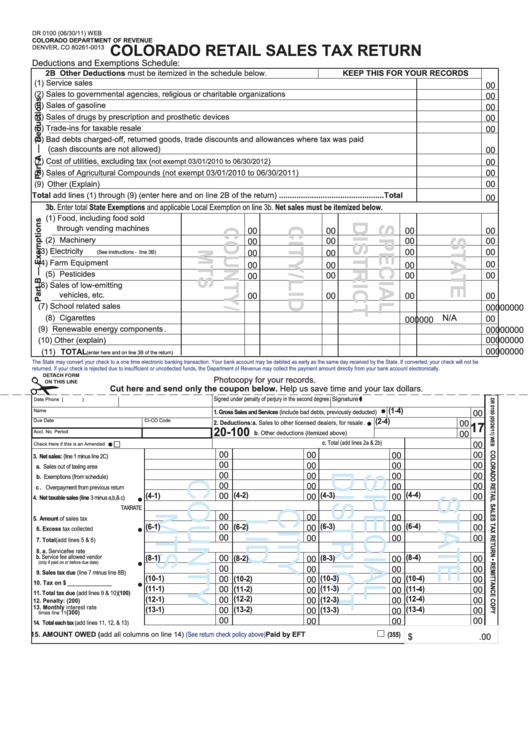

DR 0100 (06/30/11) WeB

ColoRado dePaRtMent oF ReVenue

ColoRado RetaIl SaleS tax RetuRn

DeNveR, CO 80261-0013

Deductions and exemptions Schedule:

2B Other Deductions must be itemized in the schedule below.

KEEP THiS FOR YOUR RECORDS

(1) Service sales ......................................................................................................................................

00

(2) Sales to governmental agencies, religious or charitable organizations ..............................................

00

(3) Sales of gasoline ................................................................................................................................

00

(4) Sales of drugs by prescription and prosthetic devices .......................................................................

00

(5) Trade-ins for taxable resale ................................................................................................................

00

(6) Bad debts charged-off, returned goods, trade discounts and allowances where tax was paid

(cash discounts are not allowed) ........................................................................................................

00

(7) Cost of utilities, excluding tax (

) .....................................................

not exempt 03/01/2010 to 06/30/2012

00

(8) Sales of Agricultural Compounds (not exempt 03/01/2010 to 06/30/2011) ........................................

00

00

(9) Other (Explain) ...................................................................................................................................

Total add lines (1) through (9) (enter here and on line 2B of the return) ................................................Total

00

3b. enter total State Exemptions and applicable Local exemption on line 3b. Net sales must be itemized below.

(1) Food, including food sold

through vending machines ...........

00

00

00

00

(2) Machinery ...................................

00

00

00

00

(3) electricity

00

00

00

00

(See instructions - line 3B) ...........

(4) Farm equipment .........................

00

00

00

00

(5) Pesticides ...................................

00

00

00

00

(6) Sales of low-emitting

vehicles, etc. ...............................

00

00

00

00

(7) School related sales ...................

00

00

00

00

N/A

(8) Cigarettes ...................................

00

00

00

00

(9) Renewable energy components .

00

00

00

00

00

00

00

00

(10) Other (explain) ............................

00

00

00

00

(11) total

(enter here and on line 3B of the return)

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your check will not be

returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

Photocopy for your records.

Cut here and send only the coupon below. Help us save time and your tax dollars.

Á

Signed under penalty of perjury in the second degree. Signature

Date

Phone (

)

•

(1-4)

Name

00

1. Gross Sales and Services (include bad debts, previously deducted) .....

•

(2-4)

Due Date

CI-CO Code

00

2. Deductions: a. Sales to other licensed dealers, for resale .

17

20-100

Acct. No.

Period

00

b. Other deductions (itemized above) ..............

•

□

c. Total (add lines 2a & 2b) ...............

00

Check Here if this is an Amended Return.................

00

00

00

00

3. Net sales: (line 1 minus line 2C) ............................

00

00

00

00

a. Sales out of taxing area ..................................

00

00

00

00

b. exemptions (from schedule) ..........................

00

00

00

00

c. Overpayment from previous return ................

•

(4-2)

(4-3)

(4-4)

(4-1)

00

00

00

00

4. Net taxable sales (line 3 minus a,b,& c) .........

TAX RATe

00

00

00

00

5. Amount of sales tax ..................................

•

(6-4)

(6-1)

00

(6-2)

(6-3)

00

00

00

6. Excess tax collected ..............................

00

00

00

00

7. Total (add lines 5 & 6)...............................

8. a. Service fee rate .....................................

b. Service fee allowed vendor

(8-4)

(8-1)

00

(8-3)

(8-2)

00

00

00

•

.........................

(only if paid on or before due date)

00

00

00

00

9. Sales tax due (line 7 minus line 8B) ............

(10-1)

00

(10-3)

(10-4)

(10-2)

00

00

•

00

10. Tax on $ ______________ .................

(11-1)

(11-3)

00

(11-2)

(11-4)

00

00

00

11. Total tax due (add lines 9 & 10) ..........(100)

(12-4)

(12-1)

00

(12-2)

(12-3)

00

00

00

12. Penalty: .......................................(200)

13. Monthly interest rate

(13-2)

(13-1)

00

(13-3)

(13-4)

00

00

00

.................................... (300)

times line 11

00

00

00

00

14. Total each tax (add lines 11, 12, & 13) ..........

(See return check policy above)

15. AMOUNT OWED (add all columns on line 14)

....................................Paid by EFT

(355)

$

.00

1

1