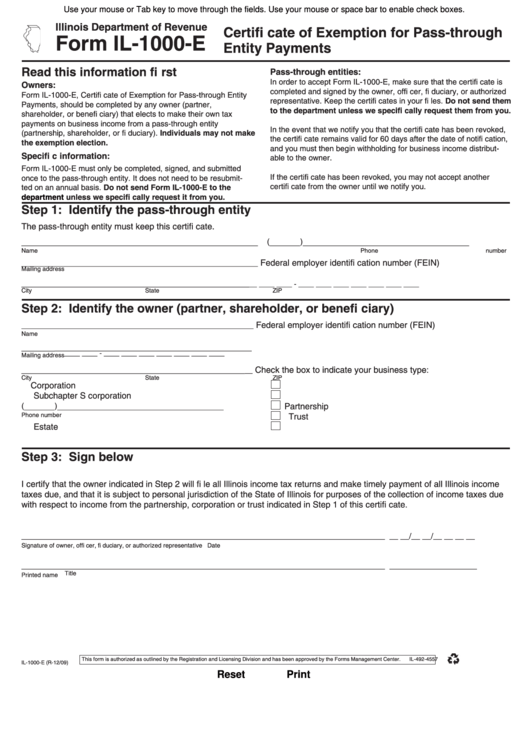

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

lllinois Department of Revenue

Certifi cate of Exemption for Pass-through

Form IL-1000-E

Entity Payments

Read this information fi rst

Pass-through entities:

In order to accept Form IL-1000-E, make sure that the certifi cate is

Owners:

completed and signed by the owner, offi cer, fi duciary, or authorized

Form IL-1000-E, Certifi cate of Exemption for Pass-through Entity

representative. Keep the certifi cates in your fi les. Do not send them

Payments, should be completed by any owner (partner,

to the department unless we specifi cally request them from you.

shareholder, or benefi ciary) that elects to make their own tax

payments on business income from a pass-through entity

In the event that we notify you that the certifi cate has been revoked,

(partnership, shareholder, or fi duciary). Individuals may not make

the certifi cate remains valid for 60 days after the date of notifi cation,

the exemption election.

and you must then begin withholding for business income distribut-

Specifi c information:

able to the owner.

Form IL-1000-E must only be completed, signed, and submitted

If the certifi cate has been revoked, you may not accept another

once to the pass-through entity. It does not need to be resubmit-

certifi cate from the owner until we notify you.

ted on an annual basis. Do not send Form IL-1000-E to the

department

unless we specifi cally request it from you.

Step 1: Identify the pass-through entity

The pass-through entity must keep this certifi cate.

( _______ ) ______________________________________

______________________________________________________

Name

Phone number

Federal employer identifi cation number (FEIN)

______________________________________________________

Mailing address

____________________________________________________

__

____ ____ - ____ ____ ____ ____ ____ ____ ____

City

State

ZIP

Step 2: Identify the owner (partner, shareholder, or benefi ciary)

Federal employer identifi cation number (FEIN)

_____________________________________________________

Name

_______

_____________________________________________

____ ____ - ____ ____ ____ ____ ____ ____ ____

Mailing address

Check the box to indicate your business type:

___________________________________________________

__

City

State

ZIP

Corporation

Subchapter S corporation

( _______ ) ______________________________________

Partnership

Phone number

Trust

Estate

Step 3: Sign below

I certify that the owner indicated in Step 2 will fi le all Illinois income tax returns and make timely payment of all Illinois income

taxes due, and that it is subject to personal jurisdiction of the State of Illinois for purposes of the collection of income taxes due

with respect to income from the partnership, corporation or trust indicated in Step 1 of this certifi cate.

___________________________________________________________________________________ __ __/__ __/__ __ __ __

Signature of owner, offi cer, fi duciary, or authorized representative

Date

___________________________________________________________________________________ ____________________

Title

Printed name

This form is authorized as outlined by the Registration and Licensing Division and has been approved by the Forms Management Center.

IL-492-4557

IL-1000-E (R-12/09)

Reset

Print

1

1