Maryland State Department of Assessments & Taxation

Page 1 of 2

APPLICATION FOR HOMESTEAD TAX CREDIT ELIGIBILITY

•

The Homestead Tax Credit law limits the amount of assessment increase on which eligible resident homeowners actually

pay county, municipal, and State property taxes each year. This credit can have a significant impact on your real

estate taxes regardless of your property’s value or your income level. If the property is used as your principal

residence, you are strongly encouraged to complete this application.

•

The reason why this application is required is to verify that the property owners only receive the benefit of this credit on

their one principal residence. It also insures that other homeowners entitled to the credit but not receiving it can also

start to receive this benefit.

•

A married couple may only have one principal residence under the provisions of this law. A homeowner who submits an

application that is inconsistent with income tax and motor vehicle records of the State shall be required to later submit

additional verification in order to be considered for the credit.

•

If you have a specific question concerning the application, you may telephone 410-767-2165 in the Baltimore

metropolitan area or on 1-866-650-8783 toll free elsewhere in Maryland.

•

This application can be filled out on your pc; if hand written please print legibly. Please use black or

blue

ink only.

___________________________________________________________________________________________________

Section I

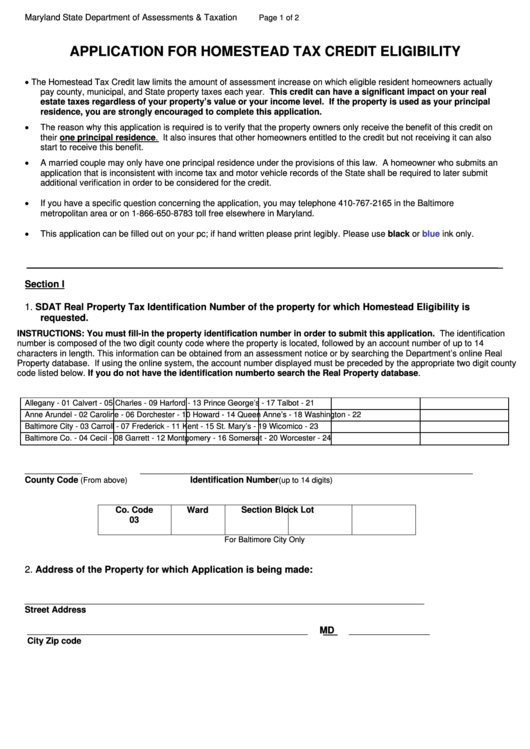

1. SDAT Real Property Tax Identification Number of the property for which Homestead Eligibility is

requested.

INSTRUCTIONS: You must fill-in the property identification number in order to submit this application. The identification

number is composed of the two digit county code where the property is located, followed by an account number of up to 14

characters in length. This information can be obtained from an assessment notice or by searching the Department’s online Real

Property database. If using the online system, the account number displayed must be preceded by the appropriate two digit county

code listed below. If you do not have the identification number

click here

to search the Real Property database.

Allegany - 01

Calvert - 05

Charles - 09

Harford - 13

Prince George’s - 17

Talbot - 21

Anne Arundel - 02

Caroline - 06

Dorchester - 10

Howard - 14

Queen Anne’s - 18

Washington - 22

Baltimore City - 03

Carroll - 07

Frederick - 11

Kent - 15

St. Mary’s - 19

Wicomico - 23

Baltimore Co. - 04

Cecil - 08

Garrett - 12

Montgomery - 16

Somerset - 20

Worcester - 24

____________

______________________________________________________________________

County Code

Identification Number

(From above)

(up to 14 digits)

Co. Code

Ward

Section

Block

Lot

03

For Baltimore City Only

2. Address of the Property for which Application is being made:

____________________________________________________________________________________

Street Address

MD

___________________________________________________________

_________________

City

Zip code

1

1 2

2