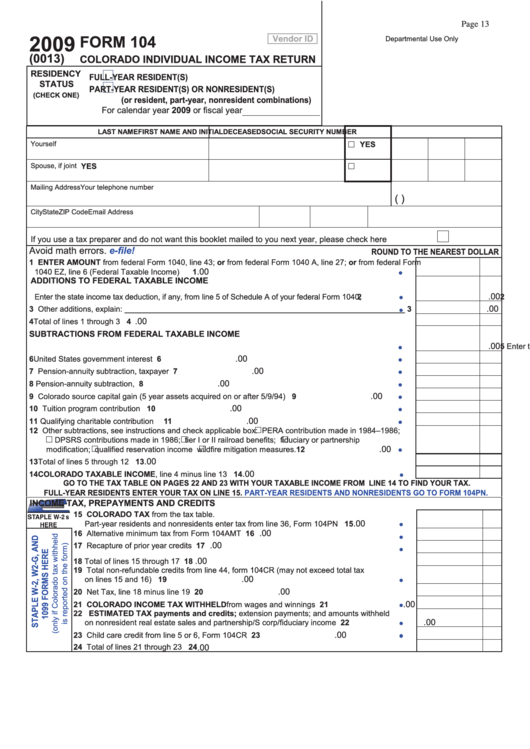

Form 104 - Colorado Individual Income Tax Return - 2009

ADVERTISEMENT

Page 13

2009

FORM 104

Vendor ID

Departmental Use Only

(0013)

COLORADO INDIVIDUAL INCOME TAX RETURN

RESIDENCY

FULL-YEAR RESIDENT(S)

STATUS

PART-YEAR RESIDENT(S) OR NONRESIDENT(S)

(CHECK ONE)

(or resident, part-year, nonresident combinations)

For calendar year 2009 or fiscal year

LAST NAME

FIRST NAME AND INITIAL

DECEASED

SOCIAL SECURITY NUMbER

Yourself

YES

Spouse, if joint

YES

Mailing Address

Your telephone number

(

)

City

State

ZIP Code

Email Address

If you use a tax preparer and do not want this booklet mailed to you next year, please check here .......................

Avoid math errors.

e-file!

ROUND TO THE NEAREST DOLLAR

1 ENTER AMOUNT from federal Form 1040, line 43; or from federal Form 1040 A, line 27; or from federal Form

.00

1040 EZ, line 6 (Federal Taxable Income) .....................................................................................................

1

ADDITIONS TO FEDERAL TAXAbLE INCOME

.00

2 Enter the state income tax deduction, if any, from line 5 of Schedule A of your federal Form 1040, ..................

2

.00

3 Other additions, explain: ________________________________________________________________

3

.00

4 Total of lines 1 through 3 .................................................................................................................................. 4

SUbTRACTIONS FROM FEDERAL TAXAbLE INCOME

.00

5 Enter the state income tax refund, if any, you reported on line 10 of your federal Form 1040 ......................

5

.00

6 United States government interest ................................................................................................................

6

.00

7 Pension-annuity subtraction, taxpayer ..........................................................................................................

7

.00

8 Pension-annuity subtraction, spouse.............................................................................................................

8

.00

9 Colorado source capital gain (5 year assets acquired on or after 5/9/94) ....................................................

9

.00

10 Tuition program contribution .......................................................................................................................

10

.00

11 Qualifying charitable contribution ................................................................................................................

11

12 Other subtractions, see instructions and check applicable box:

PERA contribution made in 1984–1986;

DPSRS contributions made in 1986;

tier I or II railroad benefits;

fiduciary or partnership

.00

modification;

qualified reservation income

wildfire mitigation measures. .......................................... 12

.00

13 Total of lines 5 through 12 ............................................................................................................................. 13

.00

14 COLORADO TAXAbLE INCOME, line 4 minus line 13 ..............................................................................

14

GO TO THE TAX TAbLE ON PAGES 22 AND 23 WITH YOUR TAXAbLE INCOME FROM LINE 14 TO FIND YOUR TAX.

FULL-YEAR RESIDENTS ENTER YOUR TAX ON LINE 15.

PART-YEAR RESIDENTS AND NONRESIDENTS GO TO FORM 104PN.

INCOME TAX, PREPAYMENTS AND CREDITS

15 COLORADO TAX from the tax table.

.00

Part-year residents and nonresidents enter tax from line 36, Form 104PN ...........................

15

.00

16 Alternative minimum tax from Form 104AMT .......................................................................... 16

.00

17 Recapture of prior year credits ................................................................................................ 17

.00

18 Total of lines 15 through 17 ....................................................................................................... 18

19 Total non-refundable credits from line 44, form 104CR (may not exceed total tax

.00

on lines 15 and 16) .................................................................................................................. 19

.00

20 Net Tax, line 18 minus line 19 .................................................................................................... 20

.00

21 COLORADO INCOME TAX WITHHELD from wages and winnings ....................................... 21

22 ESTIMATED TAX payments and credits; extension payments; and amounts withheld

.00

on nonresident real estate sales and partnership/S corp/fiduciary income ............................. 22

.00

23 Child care credit from line 5 or 6, Form 104CR ....................................................................... 23

24 Total of lines 21 through 23 ....................................................................................................... 24

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2