Form Ct-1120x Amended Corporation Business Tax Return - 2005

ADVERTISEMENT

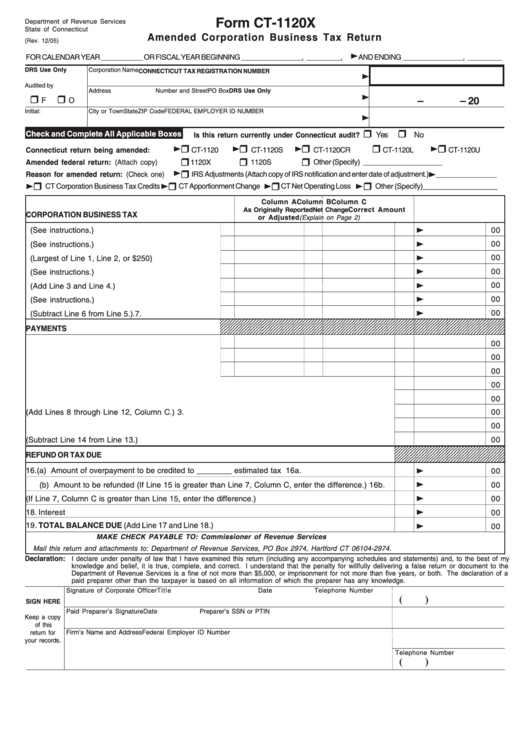

Form CT-1120X

Department of Revenue Services

State of Connecticut

Amended Corporation Business Tax Return

(Rev. 12/05)

FOR CALENDAR YEAR ___________ OR FISCAL YEAR BEGINNING ________________, _________,

AND ENDING ________________, _________

DRS Use Only

Corporation Name

CONNECTICUT TAX REGISTRATION NUMBER

Audited by

Address

Number and Street

PO Box

DRS Use Only

–

– 20

F

O

Initial:

City or Town

State

ZIP Code

FEDERAL EMPLOYER ID NUMBER

Check and Complete All Applicable Boxes

Yes

No

Is this return currently under Connecticut audit?

Connecticut return being amended:

CT-1120

CT-1120S

CT-1120CR

CT-1120L

CT-1120U

Amended federal return: (Attach copy)

1120X

1120S

Other (Specify) ____________________

Reason for amended return: (Check one)

IRS Adjustments (Attach copy of IRS notification and enter date of adjustment.)

________________

CT Corporation Business Tax Credits

CT Apportionment Change

CT Net Operating Loss

Other (Specify) __________________

Column A

Column B

Column C

As Originally Reported

Net Change

Correct Amount

CORPORATION BUSINESS TAX

or Adjusted

(Explain on Page 2)

1. Tax on net income (See instructions.) ...................... 1.

00

00

2. Minimum tax on capital (See instructions.) .............. 2.

00

3. Tax (Largest of Line 1, Line 2, or $250) .................... 3.

00

4. Surtax (See instructions.) .......................................... 4.

00

5. Total tax before credits (Add Line 3 and Line 4.) ...... 5.

00

6. Total credits (See instructions.) ................................ 6.

00

7. Total tax after credits (Subtract Line 6 from Line 5.) . 7.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

PAYMENTS

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

8. Overpayment from prior year .................................... 8.

00

9. Estimated tax payments ........................................... 9.

00

10.Paid with extension ................................................... 10.

00

11. Tax paid with original return ......................................................................................................................

11.

00

12. Tax paid after filing return ..........................................................................................................................

12.

00

00

13. Total payments (Add Lines 8 through Line 12, Column C.) ....................................................................

13.

00

14. Overpayment on original return or as last adjusted ................................................................................

14.

15. Net payments to date (Subtract Line 14 from Line 13.) ...........................................................................

15.

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

REFUND OR TAX DUE

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

16. (a) Amount of overpayment to be credited to ________ estimated tax .................................................. 16a.

00

(b) Amount to be refunded (If Line 15 is greater than Line 7, Column C, enter the difference.) ............ 16b.

00

17. Tax Due (If Line 7, Column C is greater than Line 15, enter the difference.) ..........................................

17.

00

18. Interest ......................................................................................................................................................

18.

00

19. TOTAL BALANCE DUE (Add Line 17 and Line 18.) ..................................................................................

19.

00

MAKE CHECK PAYABLE TO: Commissioner of Revenue Services

Mail this return and attachments to: Department of Revenue Services, PO Box 2974, Hartford CT 06104-2974.

Declaration:

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my

knowledge and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a false return or document to the

Department of Revenue Services is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The declaration of a

paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Signature of Corporate Officer

Title

Date

Telephone Number

(

)

SIGN HERE

Paid Preparer’s Signature

Date

Preparer’s SSN or PTIN

Keep a copy

of this

Firm’s Name and Address

Federal Employer ID Number

return for

your records.

Telephone Number

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2